Tesla earnings report Q1 2025 has raised eyebrows in the financial world as the electric vehicle giant reported disappointing figures that missed analyst expectations. The company’s revenue fell by a staggering 20% year-over-year, prompting discussions on Tesla’s future in an increasingly competitive electric vehicle market. In what many are calling a challenging quarter for Elon Musk and his team, the decline in automotive revenue was compounded by escalating concerns over Tesla stock performance, which has plummeted 41% in 2025 alone. As detailed in the report, the ripple effects of shifting trade policies and reduced average selling prices have severely impacted Tesla’s revenue stream. Analysts are keenly examining the implications of these results, particularly in the context of the broader automotive landscape, as Tesla’s Q1 2025 results signal potential challenges ahead.

In the latest financial disclosure, Tesla unveiled its performance for the first quarter of 2025, casting a shadow over its ambitions in the automotive sector. The announcement highlighted a significant downturn in revenue figures, raising questions about the sustainability of Tesla’s market position against rising competition in the electric vehicle industry. CEO Elon Musk’s recent engagements with political leaders have drawn attention to supply chain issues that continue to affect the company adversely. Furthermore, investors are left reflecting on the ramifications of these quarterly results, which underscore a decline in profitability and stock performance. As the electric vehicle market evolves, the future trajectory for Tesla hangs in the balance, inviting speculation and analysis.

Tesla Q1 2025 Earnings Report Overview

The Tesla earnings report for Q1 2025 revealed a concerning financial landscape for the electric vehicle titan. It reported a revenue decline of nearly 9% year-over-year, culminating in a total revenue of $19.34 billion. This was significantly below the anticipated $21.11 billion, demonstrating a stark deviation from Wall Street expectations. Automotive revenue specifically saw a sharp drop of 20%, which is an alarming signal amid growing competition within the electric vehicle market. As consumer preferences evolve, Tesla’s ability to adapt and innovate will be paramount in navigating these turbulent waters.

Moreover, Elon Musk’s leadership is increasingly being scrutinized as the company faces mounting challenges. The reported decline in earnings per share, falling to 27 cents adjusted against expectations of 39 cents, raises questions about the sustainability of Tesla’s growth trajectory. Investors are closely monitoring how Musk will pivot in response to these challenges, especially considering that the automotive sector’s downturn could reflect broader economic trends affecting consumer spending on high-ticket items.

Impact of Automotive Revenue Decline on Tesla’s Future

The automotive revenue decline observed in Tesla’s Q1 2025 results has significant implications for the company’s future direction. With the automotive revenue plummeting to $14 billion from $17.4 billion, the company must strategically navigate obstacles to regain its competitive edge in the market. Analysts suggest that Tesla’s proactive initiatives in refreshing its production lines for models, particularly the Model Y, are essential for spurring sales momentum and maximizing production efficiencies. Yet, this challenge is exacerbated by decreasing average selling prices without the corresponding volume growth to offset losses.

As a consequence of these developments, concerns over Tesla’s stock performance have intensified, with shares slipping 41% since the beginning of the year. This decline could signal a potential reevaluation of Tesla’s market position by investors, particularly in light of its vulnerability to lower-cost competitors, particularly in the robust Chinese EV market. The company must reaffirm its market leadership through innovations, particularly in enhancing consumer appeal and overcoming price-related challenges.

Elon Musk and his team will need to closely monitor feedback from the electric vehicle market and adjust their strategies accordingly. The integration of cutting-edge technology and consumer-centric approaches will be critical in reversing the trend of diminishing revenues and aligning with evolving market demands.

Elon Musk’s Leadership and Its Influence on Tesla

Elon Musk’s leadership has been a cornerstone of Tesla’s branding and operational strategy; however, recent developments have drawn scrutiny regarding his focus. Reports indicate that Musk has been preoccupied with political engagements, including significant time spent in the White House, which could detract from his attention to Tesla’s operational challenges. As the market grapples with fluctuating trade policies and the impacts of federal tariffs on essential components, stakeholders are becoming increasingly concerned about this shift in focus. Musk’s political visibility raises questions about his capacity to drive Tesla’s innovation agenda amid adversities.

Investors are keenly aware that Musk’s decisions have far-reaching effects on Tesla’s trajectory, especially during times of volatility. The ongoing debates and geopolitical tensions can affect the cost structure of manufacturing and supply chains, ultimately impacting Tesla’s pricing strategies. In the face of such challenges, Musk must demonstrate an unwavering commitment to steering Tesla through these rough waters, fostering resilience and adaptability as a response to the evolving demands of the electric vehicle market.

Tesla’s Stock Performance Amidst Financial Disappointments

The decline in Tesla’s stock performance has mirrored the company’s disappointing Q1 2025 earnings report, leading to a status of caution among investors. The stocks, having dropped 41% this year, pose a significant concern for shareholders. The connection between the financial metrics reported—like the 71% plunge in net income and reduced earnings per share—and their corresponding effects on stock prices cannot be overstated. For many investors and analysts, a severe drop in stock value raises alarms about Tesla’s competitive viability and future profitability in a rapidly evolving market.

In light of ongoing challenges, including issues related to production line updates and competition, Tesla must not only manage current stock declines but also take actionable steps toward restoring investor confidence. As the company prepares for its analyst call, the focus will likely be on addressing concerns raised in the earnings call while elucidating strategies to stabilize and rebound stock performance. Key discussions might revolve around innovative strategies Musk is planning to employ to reclaim lost market ground.

Challenges in the Electric Vehicle Market

Tesla’s experience in Q1 2025 highlights the larger challenges facing the electric vehicle market. With increasing competition from lower-cost rivals, particularly in key international markets like China, Tesla faces pressure not only to innovate but also to adjust pricing structures to sustain market share. The 13% year-over-year drop in first-quarter deliveries, combined with declining automotive revenues, underscores the importance of industry dynamics affecting demand for electric vehicles. The volatility within the automobile sector is becoming more pronounced, necessitating a proactive response by Tesla to remain competitive.

In response to these mounting pressures, Tesla’s executives have asserted the need for a fresh assessment of their market strategy, particularly as they prepare for their pilot launch in Austin. The shifting political sentiment and evolving regulatory landscape will also play a critical role in shaping Tesla’s responses to the external pressures of the electric vehicle market. This adaptability is crucial in ensuring that the company not only survives during these downturns but emerges stronger and more innovative in its approach to future product offerings.

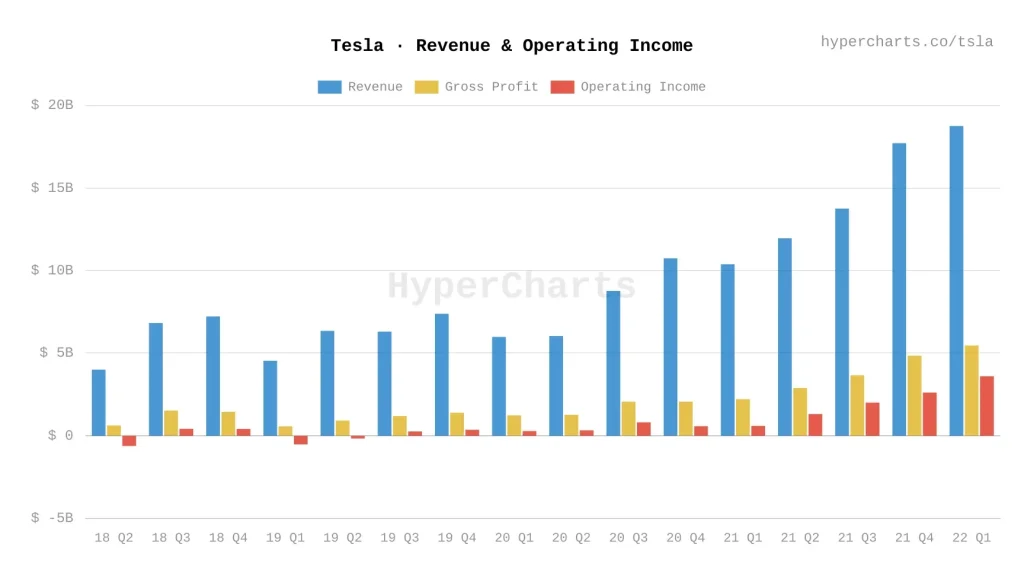

Insights on Tesla’s Operating Income and Margins

Tesla’s reported operating income dropped significantly this quarter, falling by 66% to just $400 million. This sharp decline highlights issues surrounding cost management and operational efficiency amid challenging market conditions. The operating margin has taken a hit, decreasing to 2.1%, which raises concerns for current and prospective investors. It illustrates how increasing expenses related to new projects, such as Tesla’s initiatives in artificial intelligence and ongoing factory updates, can negatively affect profitability.

Without revenue generated from environmental regulatory credits—which totaled $595 million this quarter—Tesla would have faced a net loss, signifying just how vital these credits are to the financial health of the company. Investors are now looking for reassurances from Tesla regarding their ability to stabilize their operating income and margins as they aim for a path of sustainable growth. As competition intensifies, focus on driving down costs and improving operational efficiency will become paramount in restoring profitability and boosting market confidence.

Future Outlook for Tesla Amidst Industry Uncertainties

The outlook for Tesla as it navigates a challenging industry landscape is filled with both potential and uncertainty. As the company has signaled a lack of promise for immediate growth this year, investors are keenly awaiting further clarifications during their Q2 updates. The context of shifting trade policies and regulatory environments adds layers of complexity, prompting a cautious approach as Tesla maneuvers through these uncertainties. The changing dynamics of the automotive market could significantly impact both consumer demand and production viability.

Despite these headwinds, there are indications that Tesla remains focused on leveraging innovation to carve out resilience. The company’s commitments to AI initiatives and robotics may offer new revenue opportunities and ultimately provide a competitive edge in the emerging electric vehicle market. However, it is critical for stakeholders to stay informed and alert to the evolving landscape, keeping a close eye on how Tesla adapts to these fluctuating circumstances and markets.

Tesla’s Response Strategy to Global Supply Chain Issues

Tesla’s response to global supply chain issues has taken center stage as a pivotal concern following its Q1 2025 earnings report. The company’s emphasis on these uncertainties showcases how geopolitical tension and trade dynamics affect essential components required for electric vehicle production. With metal tariffs and raw material supply chains at risk, Tesla’s focus on building robustness into its sourcing strategies will be vital in ensuring production continuity. Feeling the strain of increasing costs, Tesla acknowledges the challenges in balancing affordability with profitability.

In the face of these obstacles, Tesla has initiated talks with its suppliers to better align future pricing and sourcing strategies, emphasizing the manufacture of essential components domestically where viable. By addressing vulnerabilities within its supply chain, the company is laying the groundwork for a more stable operational framework while focusing on building a resilient ecosystem for the growth of electric vehicle production. Investors and market analysts will be scrutinizing how effectively these strategies mitigate risk and pave the way for future growth.

Conclusion: Preparing for Tesla’s Next Steps

In conclusion, preparing for Tesla’s next steps is fundamental following the stark results of the Q1 2025 earnings report. The reported revenue declines, challenges in automotive sales, and stock performance collectively emphasize the need for strategic realignment within the company. Elon Musk’s leadership will be pivotal as the company explores new growth avenues, especially in its plans for autonomous vehicles and AI-enhanced products. Stakeholders must remain vigilant as they await updates on how these strategies will translate into market performance.

It will be crucial for Tesla to communicate transparently with investors during its upcoming calls, particularly about plans to address current crises while retaining focus on long-term goals. By balancing immediate responses with visionary strategies in the electric vehicle market, Tesla can position itself to recover and thrive in an increasingly competitive landscape. The ability to adapt and innovate in the face of change remains key to maintaining its market leadership and achieving sustainable growth.

Frequently Asked Questions

What were the key highlights from Tesla’s earnings report Q1 2025?

Tesla’s Q1 2025 earnings report revealed disappointing results, with total revenue decreasing by 9% year-over-year to $19.34 billion, missing the estimated $21.11 billion. Automotive revenue specifically fell by 20%, totaling $14 billion, alongside a significant net income drop of 71% to $409 million. The company indicated challenges related to production updates and declining average selling prices.

How did Tesla’s stock perform following the Q1 2025 earnings report?

After Tesla’s Q1 2025 earnings report, the company’s stock has seen a significant decline, dropping 41% year-to-date. Following the report’s release, however, shares showed resilience, initially remaining unchanged before surging nearly 5% after positive news regarding Federal Reserve Chair Jerome Powell.

What factors contributed to the revenue decline in Tesla’s Q1 2025 results?

The revenue decline in Tesla’s Q1 2025 results was attributed to the need for updates in production lines for the Model Y SUV, declines in average selling prices, and a reduction in sales promotions. The overall impact was compounded by external factors, including changing trade policies and market volatility.

What impact has the electric vehicle market had on Tesla’s performance in Q1 2025?

The electric vehicle market has posed significant challenges for Tesla in Q1 2025, particularly due to competition from lower-cost rivals in China and decreased demand. Furthermore, Tesla reported a 13% year-over-year drop in vehicle deliveries, signaling increased pressure in the current market landscape.

What did Elon Musk mention regarding Tesla’s future guidance during the Q1 2025 earnings call?

During the Q1 2025 earnings call, Elon Musk indicated that Tesla would not provide growth assurances for the year and plans to revisit guidance in the Q2 update. This uncertainty stems from rapidly changing trade policies affecting the automotive and energy markets.

How did Tesla’s energy generation and storage segment perform in Q1 2025?

Tesla’s energy generation and storage segment saw a significant boost in Q1 2025, with revenue soaring by 67% to $2.73 billion compared to $1.64 billion a year prior. The growth was tied to advancements in AI infrastructure aiding energy storage solutions and market stabilization efforts.

What regulatory credits impacted Tesla’s financial results in Q1 2025?

In Tesla’s Q1 2025 earnings report, revenue from environmental regulatory credits rose to $595 million, demonstrating a crucial financial cushion. Without these credits, Tesla would have reported a loss in automotive sales, highlighting their importance to the company’s overall financial health.

What challenges did Tesla face in Q1 2025 regarding its supply chain?

Tesla faced significant supply chain challenges in Q1 2025, driven by increasing tariffs impacting essential components like automotive parts and manufacturing equipment. These challenges were exacerbated by ongoing political changes and trade policy uncertainties affecting global supply dynamics.

Why did Tesla’s automotive division see a 20% revenue decline in Q1 2025?

The automotive division’s 20% revenue decline in Q1 2025 was largely due to necessary updates for production lines in preparation for a refreshed Model Y SUV, alongside reductions in average selling prices and promotional activities, leading to diminished sales volume.

Are there any upcoming developments for Tesla’s autonomous vehicle initiatives as mentioned in the Q1 2025 report?

Yes, Tesla confirmed plans for a pilot launch of its driverless ride-hailing service in Austin, Texas, set for June 2025. Additionally, the company intends to begin building humanoid robots on a pilot production line in Fremont, California within the year.

| Key Point | Details |

|---|---|

| Earnings Report Summary | Tesla’s Q1 2025 earnings report indicates a miss on revenue and earnings expectations. |

| Earnings per Share | 27 cents adjusted vs. 39 cents estimated. |

| Revenue | $19.34 billion reported vs. $21.11 billion estimated. |

| Automotive Revenue | Fell 20% to $14 billion from $17.4 billion year-over-year. |

| Net Income | Plunged 71% to $409 million, 12 cents per share. |

| Operating Income | Down 66% to $400 million, with a 2.1% operating margin. |

| Energy Revenue | Surged 67% to $2.73 billion from $1.64 billion a year ago. |

| Market Concerns | Heightened uncertainty due to changing trade policies. |

| Future Outlook | Tesla will reassess its 2025 guidance during Q2 update. |

Summary

The Tesla earnings report Q1 2025 highlights significant challenges for the automaker as it missed both revenue and earnings expectations. With a 20% decline in automotive revenue and a sharp drop in net income, Tesla’s results reflect the impact of increased competition, operational adjustments, and adverse market conditions. These developments, alongside changing trade policies and rising tariffs, underscore a challenging environment for the company as it navigates through this turbulent period. As Tesla commits to innovative ventures such as autonomous ride-hailing services and energy solutions, it remains to be seen how these strategies will mitigate current setbacks and foster growth in the coming quarters.