Monetary Policy and the Economy shape many daily experiences, from grocery prices to the jobs people can find. Understanding central banks actions helps explain how borrowing costs move and how households respond to changes in policy, including the interplay of interest rates and inflation. The path from a policy decision to the effects on prices and growth runs through the monetary policy transmission mechanism, with inflation targeting helping to keep expectations anchored. Policy choices seek to balance price stability with monetary policy and economic growth, recognizing that shocks and time lags matter. By examining the tools of central banks—such as interest rate adjustments, asset purchases, and clear forward guidance—readers can see how decisions today shape tomorrow’s inflation and employment.

Viewed in different terms, the central banking framework uses policy rates, expectations guidance, and balance sheet actions to influence demand and activity. These instruments affect credit supply, financial liquidity, and the confidence of households and businesses. The aim remains price stability and sustainable growth, though the route varies with the size of the economy and the business cycle. By focusing on related concepts such as policy rate decisions and transmission channels in accessible language, readers can connect macro policy to everyday outcomes.

Monetary Policy and the Economy: How Central Banks Use Interest Rates, Inflation Targeting, and the Transmission Mechanism

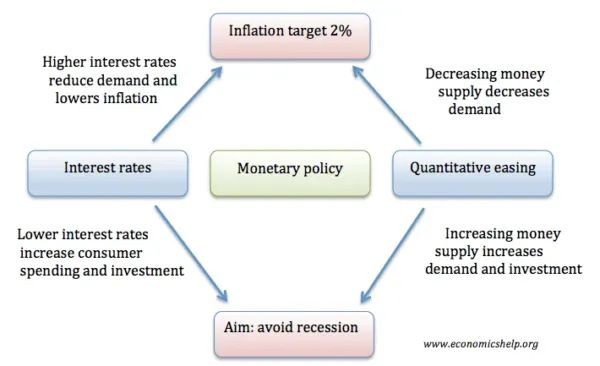

Monetary Policy and the Economy refers to the set of actions that central banks undertake to influence a nation’s money supply and credit conditions with the aim of achieving macroeconomic objectives such as stable prices and maximum employment. Central banks actions—adjusting policy rates, guiding expectations, and, when needed, engaging in asset purchases—shape the trajectory of interest rates and the path of inflation. Inflation targeting provides a clear, publicly communicated benchmark that helps households and businesses form credible plans around prices over time.

Through the monetary policy transmission mechanism, policy moves ripple through borrowing costs, lending standards, asset prices, and exchange rates. These channels influence consumer spending, business investment, and hiring decisions, eventually shaping inflation and growth. While the goal is price stability and sustainable employment, the effects unfold with lags and can be influenced by financial conditions, credit availability, and how households and firms respond to evolving price signals. In practice, monetary policy and economic growth are linked through a careful balance of stimulus and restraint.

Understanding the Monetary Policy Transmission Mechanism: From Central Bank Actions to Economic Growth

The transmission mechanism describes how central bank actions translate into changes in inflation and output through multiple channels. The interest rate channel alters the cost of borrowing for mortgages, autos, and business investment, nudging demand up or down. The credit channel shapes banks’ willingness to lend, which can amplify or dampen the impact of policy on spending and investment.

Other pathways, such as asset prices, exchange rates, and expectations, also play critical roles. Higher asset prices can boost household wealth and confidence, while a weaker currency can support exports but raise import prices, affecting inflation dynamics. Together, these channels determine how monetary policy translates into monetary policy and economic growth, highlighting the importance of timing, credible guidance, and the broader policy mix in achieving inflation targets and jobs growth.

Frequently Asked Questions

How do central banks actions influence Monetary Policy and the Economy, and what role do interest rates play in inflation and growth?

Central banks adjust policy rates, conduct asset purchases, and use forward guidance to steer money supply and credit conditions. These actions influence demand through multiple transmission channels: the interest rate channel lowers or raises borrowing costs; the credit channel affects lending standards and credit availability; the asset prices channel changes household wealth and confidence; the exchange rate channel influences trade and inflation; and the expectations channel shapes spending today. Together, these channels help move inflation toward the target and support sustainable economic growth, though effects take time and vary across economies.

What is the monetary policy transmission mechanism, and how does it relate to inflation targeting and monetary policy and economic growth?

The monetary policy transmission mechanism describes how policy decisions pass through financial and real markets to affect inflation and growth. When policy rates fall, borrowing costs ease, boosting demand and growth; inflation typically moves toward the central bank’s inflation target after a lag. Conversely, rate hikes constrain demand to keep inflation in check. Inflation targeting provides a numeric anchor for price stability, while the broader goal of monetary policy and economic growth guides the degree and timing of tightening or easing, with outcomes shaped by financial conditions, credit availability, and external shocks.

| Aspect | Key Points |

|---|---|

| What is Monetary Policy and the Economy? | Central banks influence money supply, credit conditions, and financial conditions to achieve macro goals (price stability and maximum employment). Tools include interest rates, expectations management, asset purchases, and macroprudential measures; policy outcomes depend on shocks and transmission to the real economy. |

| Tools of Monetary Policy and Their Effects | Policy rate is the primary instrument: lower rates stimulate spending and investment; higher rates cool demand. Quantitative easing lowers long-term rates by asset purchases. Reserve requirements and macroprudential tools influence bank lending. Forward guidance shapes expectations and can move markets even before rate changes. |

| Transmission Mechanisms: How Policy Reforms the Economy | Channels: Interest Rate Channel, Credit Channel, Asset Prices Channel, Exchange Rate Channel, and Expectations Channel. These channels interact, operate with lags, and vary across countries; the overall impact depends on financial structure and policy credibility. |

| Goals, Trade-offs, and Limits | Mandate typically includes price stability and employment; short-run trade-offs may occur. Supply shocks can complicate achieving targets; zero lower bound limits conventional policy; unconventional tools like QE can help. Communication and transparency anchor expectations. |

| Real-World Considerations and Case Examples | Past episodes show policy toolkits in action: post-2008 crisis easing, COVID-19 responses, and the need for policy coordination with fiscal measures. These cases illustrate transmission channels and limits, influencing inflation, growth, and unemployment trajectories. |

Summary

Monetary Policy and the Economy describe how central banks influence the money supply and credit conditions to guide inflation, growth, and jobs. By adjusting policy rates, engaging in asset purchases, and shaping expectations, central banks affect households, firms, and financial markets through several transmission channels. The interplay among these tools and channels creates outcomes with lags and cross-sector spillovers, making price stability and maximum employment a balancing act. In a world of evolving financial systems, global capital flows, and technological change, the core principles of Monetary Policy and the Economy remain: credible targets, transparent communication, and adaptable strategies help economies navigate shocks and sustain steady growth. Understanding these dynamics helps explain current events and prepares us for how future policy moves may shape everyday life.