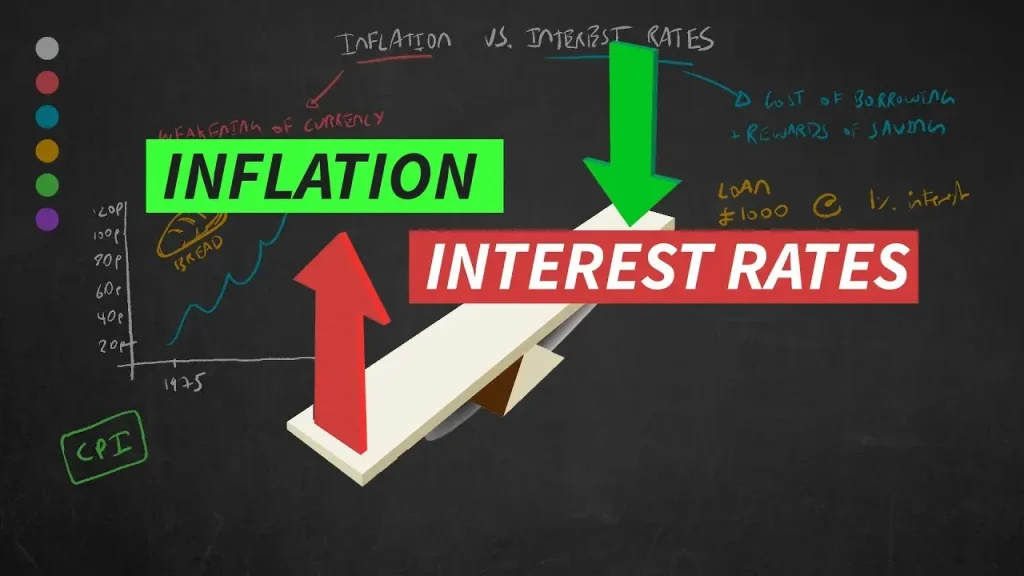

Inflation and Interest Rates are the weather through which households budget, firms invest, and governments set policy. As the economy moves from unusually high inflation toward a slower normalization, the monetary policy impact and central bank policy signals help shape the limits and opportunities for borrowers, investors, and savers. Inflation expectations influence wage bargaining and pricing decisions, which in turn affect consumer spending and the broader economic outlook. Because policy works with lags and depends on energy costs, supply chains, and labor markets, readers should translate macro signals into practical budgeting and financing choices. This introductory overview aims to connect the dots so you can anticipate likely paths for rates and prices and plan accordingly.

From another angle, price pressures and borrowing costs become the levers shaping budgets, investments, and policy expectations. Markets watch the path of policy rates, the stance of the central bank, and signals about asset holdings as clues to future financing conditions. These dynamics are tied to inflation expectations, currency moves, and consumer confidence, all feeding into the broader economic outlook. Using these related concepts—price stability, credit conditions, and policy guidance—helps readers understand the topic with fresh terminology that aligns with modern search behavior.

Inflation and Interest Rates: Navigating the Next Phase of Monetary Policy and Its Real-World Effects

Inflation and Interest Rates act as the weather for household budgets, business planning, and government policy. As price pressures begin to normalize from a period of unusually high inflation, policy makers balance the need to cool demand with the goal of not stalling growth. This is the essence of the monetary policy impact, where rate decisions, forward guidance, and balance sheet actions interact with supply conditions to influence the standard of living and the trajectory of the economy.

The transmission from policy to the real economy unfolds through multiple channels. Higher policy rates typically raise borrowing costs, dampening purchases of homes, cars, and equipment. Tighter financial conditions can slow investment and hiring, gradually easing wage pressures over time. Currency movements and shifts in inflation expectations further shape import prices and export competitiveness, highlighting how central bank policy and market expectations work together to steer economic outcomes.

For households and businesses alike, the coming months demand attentive planning. Mortgage and debt decisions, refinancing opportunities, and cash-flow management sit at the core of preparing for potential rate moves. A prudent approach to budgeting, debt management, and liquidity can help maintain resilience as the economic outlook evolves and consumer spending patterns adapt to higher or more slowly retreating borrowing costs.

Central Bank Policy Signals, Inflation Expectations, and the Economic Outlook: Implications for Spending and Investment

Central banks communicate policy paths through rate announcements, forward guidance, and asset operations, and these signals can be as influential as the moves themselves. By anchoring inflation expectations and clarifying the trajectory of policy, such communications reduce uncertainty and help households and businesses plan for the medium term. This dynamic—the interplay of central bank policy, market expectations, and the broader economic outlook—is central to understanding how monetary policy impact translates into everyday financial decisions.

Several plausible scenarios illustrate how inflation expectations and policy signals may play out. In a baseline case, inflation gradually cools as supply chains normalize, allowing central banks to move toward steadier rates and a modestly improving economic outlook. If price pressures remain sticky, hawkish persistence could keep rates elevated longer, dampening consumer spending and capex. Surprises to the upside or global spillovers can inject renewed uncertainty, affecting bond yields, currency values, and investment plans—highlighting why monitoring central bank policy and inflation expectations is essential for strategic planning.

Practically, readers can translate these signals into action: review debt structures and refinancing options to align with the policy outlook, diversify investments to balance risk and duration, and keep a close eye on inflation expectations and consumption trends. By tying the policy path to concrete decisions—such as how much to spend on big-ticket items, when to lock in rates, or how to adjust a portfolio for changing discount rates—households and businesses can bolster resilience against a shifting monetary environment.

Frequently Asked Questions

How do Inflation and Interest Rates interact with monetary policy impact to influence consumer spending?

Inflation and Interest Rates interact through the monetary policy impact channel. When inflation runs hotter than target, central banks typically raise policy rates to cool demand. This policy action, and the time lags involved, determine how borrowing costs, investment, currency moves, and expectations feed through to the real economy.

Key channels:

– Borrowing costs: higher rates raise mortgage, car loan, and business loan rates, slowing demand and price growth.

– Investment and hiring: tighter credit weighs on capital spending and hiring, moderating wage pressures over time.

– Currency movements: higher rates can attract capital, strengthening the domestic currency and potentially lowering import prices, while also impacting exporters.

– Inflation expectations: if households and firms expect inflation to stay elevated, they may speed up wage bargaining or price setting, reinforcing price pressures.

Impact on consumer spending: With higher financing costs, households may reduce big-ticket purchases and adjust budgets. Savers may benefit from higher safe-asset yields, while risk assets can soften as discount rates rise.

Practical takeaway: align plans with the probable path of rates and inflation expectations by reviewing debt, refining budgets, and considering refinancing where it lowers overall costs.

How does central bank policy shape Inflation and Interest Rates, and what does that imply for the economic outlook?

Central bank policy guides the trajectory of Inflation and Interest Rates through rate decisions, forward guidance, and balance sheet actions. A credible policy path helps anchor expectations and influence longer-term rates, even before policy moves occur.

Key scenarios to consider:

– Baseline: Inflation gradually cools as supply chains normalize; central banks hold rates steady with a slower pace of later cuts, supporting a modestly improving economic outlook.

– Hawkish persistence: If price pressures stay firmer than expected, policy rates stay higher for longer, cooling consumer spending and delaying investment.

– Inflation surprises to the upside: A faster rebound in prices could prompt further tightening or delayed cuts, weighing on near-term growth.

– Global spillovers: Global factors can influence domestic inflation and rates through trade, currencies, and capital flows.

Implications for households and businesses:

– Mortgages and debt: Higher rates raise payments on existing loans and may slow new borrowing; lower rates can ease debt service costs.

– Investment: Higher discount rates can dampen asset prices or shift portfolios toward shorter duration assets; ongoing vigilance on inflation expectations helps manage risk.

– Planning: Monitor central bank communications and data on inflation, wages, and consumer spending to adjust plans before policy moves materialize.

Bottom line: a clear and credible central bank policy path reduces uncertainty, helping households, investors, and businesses prepare for the evolving economic outlook.

| Key Point | Summary / Details | Implications |

|---|---|---|

| Relationship between inflation and policy rates | When inflation runs hot, central banks typically raise policy rates to cool demand; when inflation cools, rates may level off or ease. Policy acts with lags and is shaped by supply chains, energy costs, labor markets, and global demand. | Affects timing of mortgages, financing, savings, and investment decisions; requires readers to consider inflation normalization pace. |

| Transmission channels from rates to the real economy | Higher policy rates raise borrowing costs, reduce investment and hiring, influence currency, and shape expectations of future inflation. | Controls demand, moderates wage pressures, affects import prices, and can alter export competitiveness; informs planning for households and firms. |

| Role of central banks and monetary policy | Central banks use rate decisions, forward guidance, and asset purchases/sales to balance price stability, employment, and financial stability. Policy tightens when inflation is above target and eases when below target. | Insiders market expectations and loan pricing; credibility of policy path can influence longer-term rates even before moves occur. |

| What to expect next: scenarios for Inflation and Interest Rates | Baseline: inflation cools gradually; rates hold mid-cycle and cuts later; Hawkish persistence: rates stay higher longer; Upside surprises: further tightening or delayed cuts; Global spillovers: international factors influence domestic dynamics. | Planning should consider a range of paths, with flexible budgeting and investment plans that anticipate different rate and inflation outcomes. |

| Implications for households and businesses | Mortgages and debt costs change with rates; saving and investing may shift toward higher yields but risk assets can be affected; consumer spending and business investment respond to financing conditions. | Plan for debt management, cash flow resilience, diversified portfolios, and prudent financing strategies to weather rate changes. |

| Practical strategies for navigating the coming months | Review debt, build a resilient budget, diversify investments by risk and duration, stay informed on policy guidance, and consider global inflation and policy signals. | Empowers readers to act proactively—refinancing when beneficial, maintaining emergency funds, and aligning portfolios with the expected inflation and policy path. |

| Risks and uncertainties to watch | New supply shocks, energy volatility, wage-price dynamics, global capital flows, and potential financial stability risks from rapid rate changes. | Prepare for volatility and build buffers; monitor indicators that could shift the inflation trajectory or policy stance. |

| Conclusion (summary of the topic) | Inflation and Interest Rates interplay shapes the path of prices, borrowing costs, and growth, and remains a moving target as data and policy signals evolve. | A balanced, data-driven plan—covering debt management, budgeting, and diversification—helps households, investors, and businesses navigate the evolving economic landscape with greater confidence. |

Summary

HTML table provided above; conclusion follows.