The global economy outlook is shaping policy debates and investor decisions as markets weigh when momentum will return. Analysts point to regional recovery leaders whose performances hinge on policy support, resilient labor markets, and demand trends. From a regional perspective, the pace of expansion varies, reflecting divergent cycles in advanced and emerging economies. The near-term outlook emphasizes the balance between inflation dynamics, investment in productivity, and the gradual normalization of supply chains. Policymakers and firms are watching how global connections unfold, with the potential for an uneven recovery that informs risk and opportunity across sectors.

Beyond the headline terms, the discussion shifts to a broader worldwide macro view that captures regional momentum, cross-border trade dynamics, and the resilience of labor markets. Economists describe the landscape in terms of regional trajectories, structural reforms, and how technology and energy transitions alter competitiveness. A holistic frame highlights the contrast between mature markets and fast-growing economies, and it considers the role of policy credibility and external funding conditions. Together these LSI-inspired cues help readers grasp the unfolding global economy through related concepts such as regional growth patterns, trade cycles, and investment catalysts.

Global Economy Outlook: Regional Recovery Leaders Driving Economic Recovery by Region

The global economy outlook today is a mosaic of regional performances, with regional recovery leaders setting the pace for many indicators as economies resume pre-pandemic activity. In each major region—Americas, Europe, Asia-Pacific—growth is being shaped by consumer demand, labor markets, and the pace of structural reforms, making the concept of economic recovery by region tangible for policymakers and investors alike. This descriptive landscape helps explain why the global economy outlook hinges on the strength of regional trajectories and how leadership from specific regions can ripple across global supply chains and financial markets.

From the perspective of global dynamics, the leadership shown by regional recovery leaders translates into a more nuanced pattern of growth. The economic recovery by region depends on effective policy normalization, favorable financing conditions, and ongoing gains in productivity from digitalization and energy transitions. As inflation moderates in some economies while remaining elevated in others, the global growth forecast 2025 will be shaped by the relative strength of regional demand, trade realignment, and the resilience of services versus manufacturing. The resulting mosaic highlights opportunities in cross-border investment and diversification, while underscoring risks tied to policy shifts or external shocks.

Global Growth Forecast 2025 and the Global Trade Revival: How Developed vs Emerging Markets Recovery Shapes the World

The global growth forecast 2025 remains a central reference point for corporate planning and policy debate, anchored by expectations of easing inflation, resilient labor markets, and gradual normalization of supply chains. A key dimension is the global trade revival, where growing trade volumes and more diversified routes can amplify investment and productivity gains across regions. In this frame, the dynamic between developed vs emerging markets recovery helps explain why some economies outpace others while the global economy maintains an uneven but advancing trajectory toward long-run potential.

Developed economies typically benefit from mature institutions, credible policy frameworks, and smoother access to financing, yet face the challenge of balancing inflation containment with long-run investment. Emerging markets, by contrast, may offer higher upside when external financing conditions ease or commodity cycles shift in their favor, though currency volatility and capital-flow sensitivity remain risks. The interaction between developed vs emerging markets recovery shapes the global growth forecast 2025 and helps determine the pace of the global trade revival, the resilience of regional demand, and the overall breadth of a sustainable global expansion.

Frequently Asked Questions

What does the global economy outlook reveal about regional recovery leaders and the economic recovery by region in 2025?

The global economy outlook shows uneven momentum across regions. Regional recovery leaders emerge where domestic demand, policy support, and resilient supply chains sustain growth, while others face inflation, financing constraints, or structural headwinds. The economic recovery by region in 2025 will hinge on domestic demand strength, policy normalization, and trade dynamics, with developed economies often leading in stability and emerging markets gradually closing the gap as external financing conditions improve.

How could the global trade revival and the global growth forecast 2025 influence the developed vs emerging markets recovery?

A global trade revival can accelerate investment and productivity by broadening market access and enabling supply-chain diversification. The global growth forecast 2025 points to a moderate expansion, sensitive to inflation, policy paths, and external demand. Developed vs emerging markets recovery is likely to diverge: developed economies may benefit from credible policy frameworks and investments in digital and green transitions, while emerging markets could offer higher upside if external financing conditions improve and domestic reforms unlock productivity.

| Key Point | Summary |

|---|---|

| Global economy outlook overview | Global economy outlook is a mosaic of regional trajectories with uneven momentum and ongoing risks; it describes how different regions rebound at varying paces. |

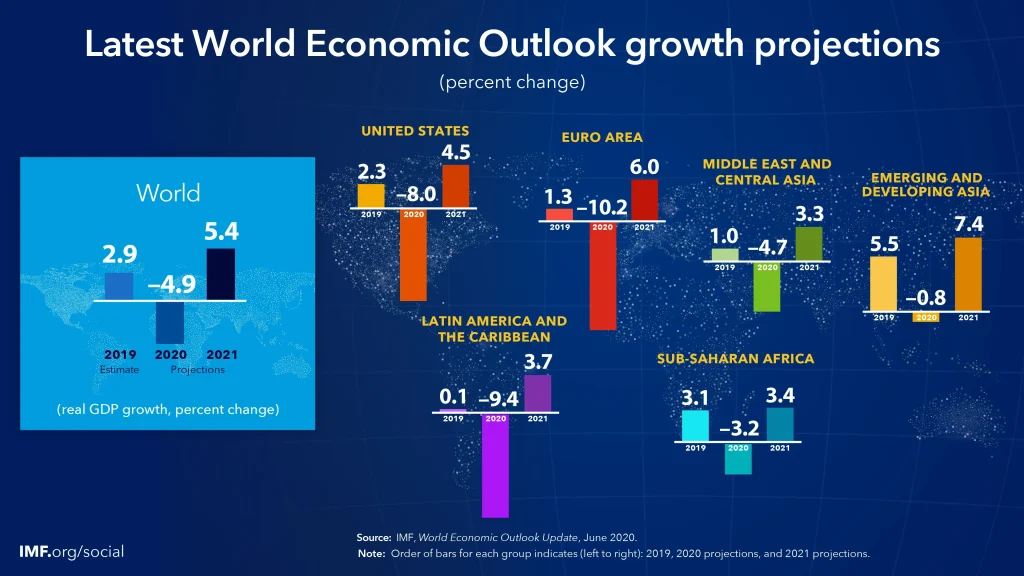

| Regional Dynamics and Leading Regions | Americas: North America shows strong recovery; Asia-Pacific export rebound with rising domestic demand; Europe catching up; Latin America mixed. |

| Economic Recovery by Region and Sectoral Impacts | In the United States and other advanced economies, consumption drives growth; Asia rebounds in manufacturing/export; Europe benefits from resilient services and gradual energy market normalization. |

| Global Growth Forecasts for 2025 and Trade Dimension | Global growth forecast 2025 is moderate and shaped by easing inflation, labor-market resilience, and supply-chain normalization, with trade remaining a key conduit and associated risks. |

| Developed vs Emerging Markets Recovery | Developed economies benefit from policy credibility and stable growth, but inflation containment remains a challenge; emerging markets may show higher volatility but greater upside with favorable external conditions. |

| Policy Implications for Sustainable Recovery | Macro stabilization, structural reforms, infrastructure investment, and open trade environments to sustain momentum and resilience. |

| Risks and Opportunities | Risks include inflation persistence, financial stability concerns, and geopolitical tensions; opportunities arise from technology adoption, green investment, and inclusive growth to enhance productivity and resilience. |

Summary

The global economy outlook is a mosaic of evolving regional narratives, each contributing to the overall trajectory of global growth. The dynamics of regional recovery leaders and the pathways of economic recovery by region help observers anticipate where momentum may persist and where vulnerabilities may emerge. The dialogue around the global growth forecast 2025, prospects for a global trade revival, and the contrasts between developed and emerging markets recovery remains central to strategic planning for businesses, investors, and policymakers. As regions advance at different speeds, a coordinated approach that supports sustainable investment, resilient supply chains, and inclusive growth will be essential to turning the global economy outlook into durable, shared prosperity for years to come.