Foreign investment in insurance is poised to undergo a transformative shift as India’s government prepares to liberalize the sector significantly. With the proposed increase of foreign direct investment (FDI) limits from 74% to an unprecedented 100%, the Indian insurance market stands at the brink of a new era. This change is part of the much-anticipated insurance reforms 2024, which aim to attract global capital and facilitate foreign ownership insurance structures. The forthcoming legislation seeks not only to ease existing regulations but also to align with global best practices, making the Indian insurance landscape more attractive to foreign investors. As the framework evolves, stakeholders are keenly observing how these reforms will reshape competition and consumer benefits in the insurance domain.

As the landscape of international financial involvement in the Indian insurance sector evolves, the notion of foreign investment in the insurance field has garnered much attention. Policies surrounding foreign direct investment (FDI) in insurance not only reflect the government’s intent to liberalize its markets but also signal a broader movement towards integrating global capital within domestic frameworks. With updated insurance reforms on the horizon, the Indian economy is set to experience a revitalization, potentially leading to enhanced market dynamics and customer service improvements. By relaxing restrictions on foreign ownership and simplifying investment regulations, India aims to attract significant foreign capital, thereby fostering a competitive environment that drives innovation in insurance offerings.

The Evolution of Foreign Investment in Insurance in India

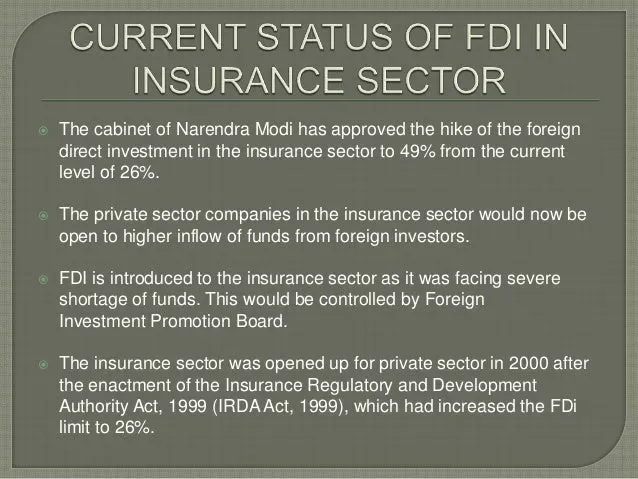

The Indian insurance sector has undergone significant transformation since the liberalization policies were introduced in the early 2000s. The initial Foreign Direct Investment (FDI) cap of 26% was considered a stepping stone, allowing limited participation of foreign entities. Over the years, this limit was progressively increased first to 49% in 2015 and, most recently, to 74% in 2021. This gradual relaxation was aimed at attracting more capital into the sector, encouraging international players to invest in India’s burgeoning insurance landscape. The introduction of the soon-to-be-launched reforms, which include an unprecedented increase in the FDI cap to 100%, marks a historical shift in the Indian insurance market, which is poised for substantial growth and international investment.

Such changes are expected to foster a more competitive environment as foreign investors, with their global expertise and resources, bring valuable insights and innovations to the local market. Additionally, easing restrictive conditions surrounding foreign ownership in Indian insurance further incentivizes foreign capital, opening doors for new partnerships and outright acquisitions. Local joint ventures that previously operated under stringent guidelines may shift to foreign ownership structures, potentially redefining competitive dynamics within the sector.

Impact of Insurance Reforms 2024 on Foreign Investment

The anticipated reforms in 2024, primarily aimed at liberalizing foreign investment rules, are set to dramatically transform the Indian insurance market. By permitting foreign entities to fully own insurance companies, the Indian government is taking a calculated step to invigorate the industry. With many entities previously hesitant to invest due to restrictive ownership rules, these reforms now present a unique opportunity for foreign players to engage deeply in the Indian market, which has been identified as one of the fastest-growing insurance markets globally. The removal of constraints on board compositions and management control could lead to a surge in investment as foreign firms can now implement their operational strategies without local limitations.

However, the reforms are not without their challenges. While they aim to simplify conditions for foreign investment, potential investors may still be cautious due to the overarching regulatory framework and the requirement for long-term capital commitment in India. The government’s assurance of reviewing and amending further provisions related to board composition and dividend payouts is likely to bolster confidence among investors. These reforms should attract institutional capital, enhance service delivery, and contribute to a heightened level of insurance penetration across India.

Understanding Foreign Ownership Trends in the Indian Insurance Market

Foreign ownership in the Indian insurance landscape has seen fluctuating trends over the past two decades. Initially characterized by cautious entry due to stringent regulations, recent trends indicate a gradual warming up to higher foreign investments. The increase in the foreign ownership limit to 74% saw minimal immediate influx, because of existing structural barriers and cautious approaches from potential foreign players. The recent announcement of elevating the limit to 100% is perceived as a bold move that could catalyze a substantial shift in foreign investment dynamics within the insurance sector.

Experts predict that such liberalization will not only attract more foreign capital but also enhance competition among both foreign and domestic insurance providers. There’s also a growing sentiment that the future of partnerships between foreign insurers and local firms could evolve into direct ownership scenarios, enabling foreign investors to drive more impactful changes within the market. Thus, understanding these trends becomes crucial for stakeholders looking to navigate the evolving landscape of foreign ownership in Indian insurance.

The Role of FDI in Shaping India’s Insurance Sector

Foreign Direct Investment (FDI) plays a pivotal role in shaping the parameters of various sectors within India, with the insurance industry being no exception. The contributions of FDI towards capital infusion not only bolster financial stability but also enhance the technology and systems employed in the sector. As regulations ease and allow for higher foreign ownership, we can expect a greater variety of products and services catering to a wider audience. This shift is expected to improve customer experiences while concurrently boosting overall insurance penetration in the country.

An increase in FDI will also encourage local companies to improve their operational efficiency to remain competitive against foreign entrants. This could lead to improved governance, innovative product offerings, and better customer service, ultimately enriching the customer experience. A well-regulated and proficient insurance sector can contribute significantly to the overall economic growth, thereby making FDI an essential component of India’s future insurance landscape.

Liberalizing the Insurance Sector: A Significant Shift

The government’s decision to liberalize the Indian insurance sector is indicative of a larger strategy to enhance the overall quality and accessibility of insurance products. By moving to a regime where foreign investment can reach 100%, India is signaling its commitment to adopting global best practices that can attract leading international players. This shift not only opens the doors for more capital but also ensures that the insurance market in India evolves to meet high global standards in terms of compliance and service delivery.

Moreover, liberalizing the insurance sector is aimed at addressing existing gaps in coverage, particularly for underserved populations in rural and low-income segments. With the introduction of composite licenses and the lowering of entry barriers, there is a greater opportunity for innovators to bring forth insurance solutions tailored to the needs of diverse demographic groups. This holistic approach is likely to make a marked difference in insurance penetration in India and position it favorably in the eyes of foreign investors.

Anticipating the Future of Mergers and Acquisitions in Insurance

As the Indian insurance market witnesses a relaxation in foreign ownership rules, analysts anticipate an uptick in mergers and acquisitions (M&A) activity in the coming months. The potential for foreign entities to gain complete control over their operations can lead to strategic partnerships, acquisitions, or the establishment of new entities that leverage both local knowledge and global practices. The M&A landscape could be reshaped as domestic firms seek to align with foreign ones for competitive advantages, thereby facilitating knowledge transfer and operational synergy.

Moreover, the increase in M&A activity could spark a wave of consolidation in the sector, leading to larger firms with enhanced capabilities to innovate and respond to market demands. Such consolidation is likely to attract more investments and result in the emergence of robust products that cater to the diverse needs of consumers. The enhanced scale of operations post-merger could also pave the way for reducing costs and improving efficiency, making insurance services more affordable and accessible to the average customer.

Challenges in Implementing Insurance Reforms

While the recent proposals to reform the Indian insurance sector are promising, the implementation of these changes will come with its own set of challenges. Foreign investors may face hurdles related to existing regulatory frameworks and operational practices accustomed to Indian norms. The need to integrate foreign operational models with local practices could be a process fraught with challenges, particularly for management and governance structures that are traditionally governed by local regulations.

Additionally, changes in laws may take time to be fully realized within the operational landscape, leading to uncertainty among potential investors. It will be crucial for the government and regulatory authorities to establish clear and transparent guidelines that facilitate a smooth transition while ensuring compliance with international standards. The success of these reforms will greatly depend on their ability to adapt swiftly to the changing dynamics and foster a conducive environment for foreign investment.

Navigating the Regulatory Environment in Insurance

The regulatory environment of the insurance sector in India is poised for significant transformation with the impending amendments. Understanding the new landscape is crucial for both domestic and foreign insurers looking to enter or expand within the market. The insurance reforms seek to simplify a previously complex framework that mandated significant local presence and restrictive ownership limits. By focusing on reviewing these existing regulations, the government aims to create a more welcoming atmosphere for foreign investments.

However, navigating the new regulatory environment will require foreign insurers to develop an in-depth understanding of local laws and operational practices. With the introduction of more nuanced conditions regarding ownership, board compositions, and dividend policies, it becomes imperative for foreign firms to strategize effectively to align with Indian regulations while maintaining their operational standards. A thorough grasp of these regulations will be a key determinant of success in the quickly evolving Indian insurance market.

The Future Landscape of Insurance Penetration in India

As the landscape of the Indian insurance market evolves with ongoing reforms and increased foreign investment, the expectation is that insurance penetration will rise substantially. Historically, India has faced challenges in achieving high levels of insurance penetration, averaging around 4% of GDP. However, with changes in regulations that invite competitive offerings from both domestic and foreign players, consumers can expect enhanced access to affordable insurance products tailored to their specific needs.

Furthermore, the commitment to liberalizing the sector may trigger a broader awareness and appreciation for insurance among the Indian populace, as improved products and marketing strategies gain prominence. As more individuals and businesses recognize the value of insurance, we may see accelerated growth, leading to more sustainable development in the sector, ultimately benefitting the economy at large. Overall, the future looks promising for insurance penetration in India, driven by strategic foreign investment and government reform initiatives.

Frequently Asked Questions

What are the recent reforms regarding FDI in insurance in India?

The recent reforms aim to liberalize foreign investment in the insurance sector by increasing the FDI limit from 74% to 100%. The government plans to simplify the existing regulations, allowing full foreign ownership of insurance companies, and will remove outdated rules, such as requiring Indian residents on the boards of these entities.

How will the proposed insurance reforms impact foreign investment in insurance companies in India?

The proposed insurance reforms are expected to significantly boost foreign investment in the Indian insurance market. By allowing 100% foreign ownership and reviewing stringent regulations, the government hopes to attract more international capital and encourage foreign companies to actively participate in the growth of the insurance sector.

What does the increase in FDI limit to 100% mean for foreign ownership in insurance?

Increasing the FDI limit to 100% means that foreign entities can fully own insurance companies in India without the need for local partners. This change is anticipated to create a more competitive environment, attracting increased foreign ownership and investment across the insurance landscape.

What key changes will the insurance reforms bring to foreign investment in insurance?

The insurance reforms will introduce several key changes, including the ability for foreign entities to own 100% of insurance companies, simplified investment rules, reduced entry barriers for new firms, and increased autonomy for the Insurance Regulatory Development Authority (IRDAI) to set licensing conditions.

Will the simplified FDI regulations affect the Indian insurance market’s growth?

Yes, the simplified FDI regulations are designed to enhance the growth of the Indian insurance market by making it more attractive to foreign investors. By removing complexities around board composition and increasing ownership limits, the reforms should lead to greater investments, increased competition, and ultimately better services and products for consumers.

How are the relaxed FDI rules expected to influence foreign investment in Indian insurance companies?

The relaxed FDI rules are expected to encourage more foreign investment in Indian insurance companies by eliminating restrictions that previously hindered foreign entities’ participation. With 100% ownership now possible, investors may find the market more appealing, leading to greater capital inflow.

What are the conditions that will still apply under the new foreign investment rules in insurance?

Under the new foreign investment rules, while the FDI limit is raised to 100%, the requirement that companies investing all their premium earnings in India remains in place. Other conditions, such as regulations regarding board composition and capital requirements for dividend payments, may also be re-evaluated to improve investment conditions.

How has previous foreign investment in insurance companies responded to higher FDI limits?

Despite previous increases in the FDI limit to 74%, foreign investment in Indian insurance companies has seen limited uptake. Experts have noted that the move to 100% FDI may yield a more favorable investment climate; however, initial reactions may vary depending on global economic conditions and individual company strategies.

What benefits can foreign companies expect from investing in India’s insurance sector?

Foreign companies investing in India’s insurance sector can expect benefits such as a rapidly growing market, increased competition leading to better consumer services, and opportunities to capitalize on the rising insurance penetration and density. Furthermore, aligning with global best practices can enhance their operational efficiency.

How do the proposed insurance reforms support long-term growth in the sector?

The proposed insurance reforms support long-term growth by encouraging foreign investment and allowing for innovations, such as composite licensing and differentiated solvency margins. This structured approach not only enhances insurance offerings but also attracts capital for technological advancements and improved infrastructure in the sector.

| Key Points |

|---|

| The government plans to liberalize foreign investment rules in the insurance sector. |

| Removal of the requirement for Indian residents on boards and senior management of insurance companies. |

| Increase in the foreign direct investment (FDI) limit from 74% to 100% for foreign entities in insurance companies. |

| Review and simplification of the current guardrails and conditions related to foreign investment. |

| Certain outdated rules, such as the board composition requirement, will be reviewed. |

| The introduction of the Insurance Reforms Bill during the ongoing budget session of parliament. |

| Economic impact includes potential changes in joint venture structures and interest in investments and mergers. |

| The draft bill proposes composite licenses for offering life and non-life products by a single entity. |

| The objective is to create a competitive environment to benefit consumers in the insurance sector. |

| Aligning India’s FDI norms with global standards to attract more foreign investment in insurance. |

Summary

Foreign investment in insurance is set for significant changes as the government proposes to remove existing barriers and increase the foreign direct investment limit from 74% to a groundbreaking 100%. By ensuring these reforms are implemented swiftly, the government aims to attract more foreign capital into the Indian insurance sector, which has seen limited participation under previous regulations. The updated policies promise not only facilitation for foreign ownership but also adjustments to outdated board and management requirements, paving the way for a more competitive and consumer-friendly market. As these reforms unfold, the insurance sector stands on the brink of transformation, with expectations of increased investments and enhanced service quality, aligning India with global best practices.