Fiscal policy and politics shape national life in fundamental ways. These choices about spending and how revenue is raised affect growth, inequality, and the everyday experiences of households. Understanding how tax policy interacts with broader economic policy can help explain why budgets reflect competing priorities and trade-offs. In democracies and many other systems, political dynamics—elections, party platforms, lobbying, and institutions—shape the pace and resilience of fiscal action. By looking at how these forces translate into public finance outcomes, readers can evaluate proposals and hold policymakers accountable.

In other words, the topic can be framed as public finances and budgetary policy, where governments decide how to allocate resources through government spending. Budget planning involves trade-offs between investments in infrastructure, health, and education, and the need to keep taxes fair and predictable. Analysts examine this landscape through terms like revenue systems, expenditure priorities, debt dynamics, and macroeconomic stewardship to capture the same ideas in an LSI-friendly language. The goal is to provide a clear sense of how public budgeting shapes growth, resilience, and opportunity for households and businesses. Taken together, these terms translate the same core idea into practical terms for policy analysis and everyday life. This framework helps readers compare proposals on fairness, effectiveness, and long-term sustainability.

Fiscal policy and politics: How government spending and tax policy shape growth, equity, and resilience

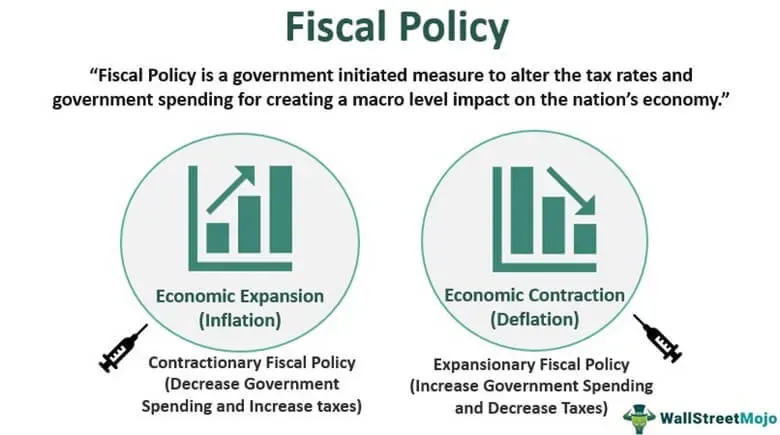

Fiscal policy and politics sit at the intersection of economics and governance, guiding how scarce resources are allocated through government spending on public goods like health care, education, and infrastructure, and through tax policy that funds these efforts. These instruments, embedded in the broader economic policy framework, influence demand, productivity, and living standards while reflecting values about fairness and risk.

Electoral incentives, party ideologies, lobbying, public opinion, and institutional rules determine which fiscal policy moves gain attention, how quickly they pass, and how resilient they will be in the face of shocks. Budget deficits—when expenditures exceed revenues—are often used to smooth cycles or finance urgent priorities, but persistent deficits can raise debt and future obligations. Understanding these dynamics helps citizens evaluate proposals and holds policymakers accountable for how spending and taxation affect households and communities.

Budget deficits, debt sustainability, and economic policy: Evaluating long-term impacts on households and markets

Budget deficits and debt sustainability are central to how economic policy is judged. When deficits finance productive investments in infrastructure, education, or health, they can boost potential growth and productivity. Yet, if deficits persist, debt service costs may constrain future policy space, influencing decisions on taxes, spending, and borrowing.

Beyond the macro numbers, fiscal choices shape daily life for households and market conditions for businesses. Markets monitor debt trajectories and interest costs, while individuals feel the effects through tax policy, the quality of public services, and access to credit. A credible fiscal policy—balancing government spending with revenue, and keeping deficits manageable—reduces uncertainty, lowers borrowing costs, and supports steady investment, employment, and long-term prosperity.

Frequently Asked Questions

How do fiscal policy and politics shape government spending and the budget deficit?

Fiscal policy and politics determine how governments allocate resources and raise revenue. Electoral incentives and budget rules influence what gets funded and when reforms occur, shaping the budget deficit trajectory. Spending on public goods and decisions in tax policy together set revenue, deficits, and debt dynamics, with deficits sometimes financing durable investments during downturns. Understanding this helps voters evaluate proposals and assess fiscal sustainability.

How do tax policy and government spending interact within fiscal policy and broader economic policy in political debates?

Tax policy and government spending are the two main levers of fiscal policy and are central to economic policy discussions. Tax policy affects incentives and revenue, while government spending determines resource allocation across health, education, infrastructure, and defense. The balance between these tools influences growth, equity, and debt sustainability, and is often debated in terms of deficits and long‑term fiscal health. Clear budgeting and accountability help translate political goals into sustainable public finance.

| Aspect | Key Points |

|---|---|

| What is Fiscal Policy? | Deliberate use of government spending and taxation to influence the economy. It includes decisions about how much to spend on public goods and how to raise revenue, aiming to affect growth, equity, and stability. In practice, fiscal policy is about allocating scarce resources to competing needs and balancing short‑term relief with long‑term investment. |

| The Political Dimension |

|

| Budgetary Tools |

|

| Economic Consequences |

|

| Evaluating Proposals |

|

| Practical Implications for Citizens and Markets |

|

Summary

Fiscal policy and politics shape the nation’s trajectory by translating values into budgets, and budgets into lived experiences. Understanding how spending priorities are chosen, how tax policy is designed, and how budget deficits are managed helps citizens participate more effectively in policy debates. It also clarifies why some proposals are implemented quickly, while others are subject to prolonged negotiation or revision. In the end, accountable governance—grounded in transparent budgeting, clear objectives, and steady evaluation—is essential for ensuring that fiscal policy advances growth, equity, and resilience for all members of society. By examining the economics of public finance through the lens of fiscal policy and politics, readers can better assess proposals, hold policymakers accountable, and imagine a more sustainable balance between prosperity and responsibility for generations to come.