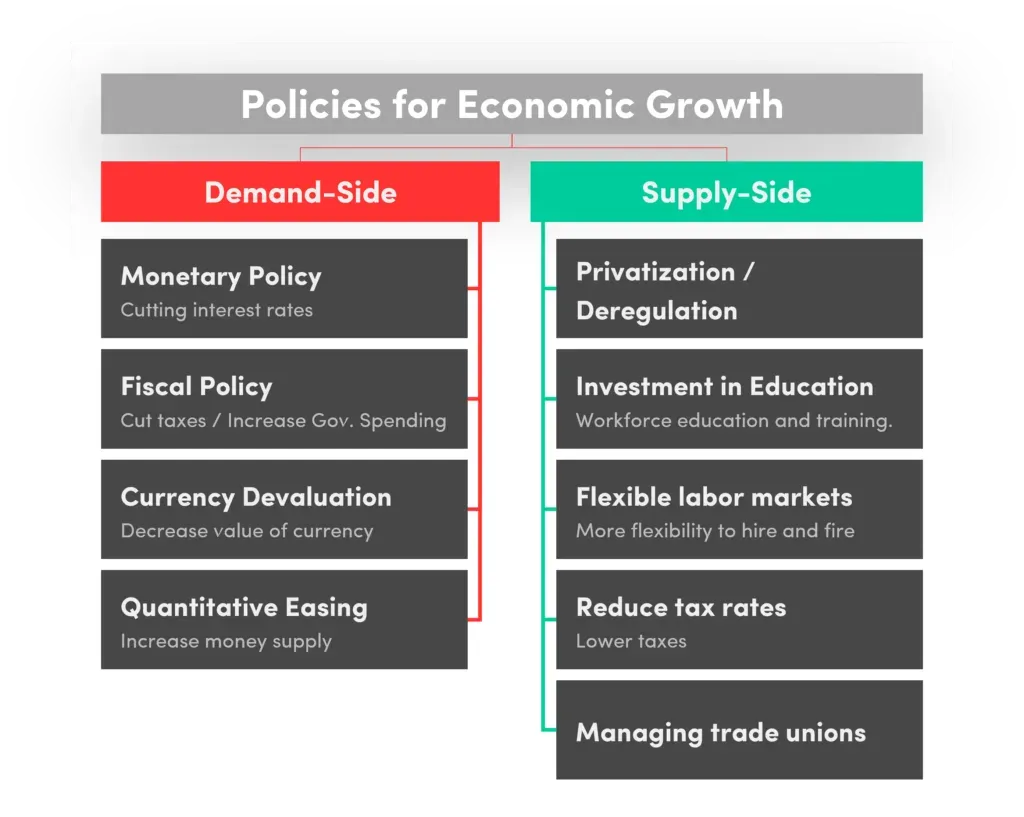

Economic policies for growth set the compass for a nation by shaping living standards, creating jobs, and pushing productivity higher through the deliberate alignment of institutions, incentives, public investment decisions, and long-run priorities that influence behavior across households, firms, and regions. Effective policy design blends prudent fiscal choices with credible, long-term plans, ensuring that deficit-financed expansion does not erode confidence while still unlocking infrastructure, education, and innovation that lift potential output and spread benefits more widely across cities and rural areas. Across the toolkit, economic growth strategies guide how governments mobilize resources, while fiscal policy for growth and monetary policy and growth interact to spark investment without fueling instability, fostering a stable environment that supports private sector risk-taking, hiring, and productivity-enhancing reforms. A transparent regulatory policy and growth agenda reduces uncertainty, lowers compliance costs, and invites patient capital to scale new ventures, production networks, and regional development projects that expand opportunity, improve logistics, and raise competitive pressures that drive efficiency across industries. Viewed through the political economy of growth, reform credibility, stakeholder buy-in, and credible sequencing turn technical ideas into durable jobs and enduring improvements in living standards by aligning incentives, communicating a clear roadmap, and sustaining reforms through successive governments.

From a Latent Semantic Indexing perspective, the core idea translates into a growth-supporting policy mix that creates an attractive investment climate, aligns public spending with productivity goals, and reduces friction for firms expanding across borders. Instead of fixed labels, narratives emphasize credible governance, predictable regulation, and the sequencing of reforms that gradually build capacity in education, infrastructure, and digital innovation. This framing links macro stability, policy credibility, and pro-market rules to tangible outcomes such as higher wages, robust entrepreneurship, and resilient supply chains. Evaluators look for indicators like stable inflation, transparent budgeting, enforcement of property rights, and scalable incentives that support long-run expansion for workers and firms alike.

Economic policies for growth: aligning fiscal, monetary, and regulatory levers

Economic policies for growth hinge on a clear, credible economic growth strategy that aligns fiscal policy for growth, monetary policy and growth, and regulatory policy and growth. A credible plan prioritizes infrastructure, education, research and development, and digital transformation to lift productivity and potential output. When budgets are disciplined and taxes incentivize investment in physical and human capital, private investment tends to accelerate and firms adopt longer planning horizons.

Yet the impact of these levers depends on the political economy of growth—how political constraints, interest groups, and electoral cycles shape policy durability. Transparent institutions, cross-party consensus on high-return projects, and robust public investment management reduce the risk of reversals and bolster the climate for innovation. Furthermore, regulatory policy and growth benefit from streamlined licensing, predictable rules, and competition-enhancing reforms that protect essential public values while avoiding excessive red tape.

Policy tradeoffs, timing, and the political economy of growth

Timing and sequencing matter in practice. A well-balanced policy mix recognizes that expansionary fiscal policy can stimulate demand in the short run, but needs credible debt management to avoid crowding out private investment. Coordinating monetary policy and growth with targeted public investment creates a smoother cycle, while policy credibility reinforces investor confidence in long-run growth strategies.

Measuring impact and communicating results are essential to sustaining momentum. Key indicators such as GDP growth, productivity, and employment illuminate whether fiscal policy for growth, monetary policy and growth, and regulatory policy and growth are delivering the expected gains. The political economy of growth requires clear budgeting, transparent evaluation, and ongoing reform to translate structural investments into lasting improvements in living standards.

Frequently Asked Questions

How do economic growth strategies and fiscal policy for growth shape economic policies for growth?

Economic policies for growth integrate growth-focused strategies with fiscal policy for growth. Economic growth strategies prioritize investments in infrastructure, education, and innovation to raise potential output, while fiscal policy for growth uses targeted spending, tax incentives, and credible debt management to crowd in private investment. Together, they raise productivity and sustainable long-run growth, but require disciplined budgeting and credible institutions to avoid deficits or inflation.

What is the role of monetary policy and growth within economic policies for growth?

Monetary policy and growth operate through price and credit channels to shape investment, spending, and employment. Central banks can stimulate activity during downturns with lower rates, asset purchases, and liquidity support, while avoiding overheating as the economy expands. When aligned with regulatory policy and growth and credible fiscal plans, a well-calibrated monetary stance provides macroeconomic stability that strengthens the impact of economic policies for growth.

| Key Point | Focus Area | Core Idea |

|---|---|---|

| Fiscal policy for growth | Fiscal policy | Government spending, taxation, and debt management shape demand, resource allocation, and long-term capital formation. When disciplined, it can crowd in private investment and fund productive public goods like infrastructure; however, deficits without credible stabilization plans can fuel inflation and erode investor confidence. |

| Monetary policy and growth | Monetary policy | Central banks influence borrowing costs and credit availability, affecting investment, private consumption, and employment. Accommodative policy can boost activity during slumps, but overheating and inflation risks require careful calibration to support long-run growth. |

| Regulatory policy and growth | Regulation | A transparent, predictable regulatory environment reduces uncertainty, lowers compliance costs, and improves capital allocation. Smart reforms remove unnecessary red tape while preserving essential protections for consumers, safety, and the environment. |

| Structural and institutional policies | Structural/Institutional | Investments in education, infrastructure, R&D, and effective labor markets raise potential output and productivity. Strong IP protection and technology transfer accelerate adoption of new ideas, amplifying the impact of other growth policies. |

| Political economy of growth | Political Economy | Growth outcomes depend on credibility, distributional effects, and the durability of reforms. Transparent communication and broad benefits help maintain investor confidence and support for sustained policy efforts. |

| Policy tradeoffs and timing | Timing/Sequencing | Every policy has costs and benefits; sequencing matters to reinforce gains across business cycles. A credible, flexible framework that adapts to data helps stabilize expectations and sustain growth. |

| Measuring impact | Measurement/Indicators | Key indicators include GDP growth, productivity, and employment. Tracking investment, skills, and research outputs enables ongoing evaluation and adjustments to keep policies effective. |

Summary

Conclusion: Economic policies for growth require coherent coordination among fiscal policy for growth, monetary policy and growth, and regulatory policy and growth, complemented by structural investments in education, infrastructure, and innovation. The political economy of growth underscores the importance of credibility, clear communication, and durable reforms for sustained progress. Policymakers who balance short-term stabilization with long-run capacity and who pursue reforms with transparency can foster an economy that grows in a sustainable and inclusive way.