Inflation and Interest Rates are not abstract numbers on a panel; they shape daily budgets and decision-making for everyday households. The inflation impact on consumers becomes most visible at the grocery store or gas pump as prices drift higher and savings stretch thinner. When the central bank tightens policy and raises interest rates, borrowing costs climb, affecting mortgage payments, car loans, and credit card minimums. These dynamics influence how households budget, save, and plan for big commitments like homes, cars, and education. This understanding helps families defend purchasing power and inflation against unpredictable price swings.

From a Latent Semantic Indexing (LSI) perspective, the topic translates into price pressures, cost of living dynamics, and the monetary policy toolkit policymakers deploy. Rather than fixating on a single figure, the discussion centers on how price growth, wage trends, and credit conditions shape everyday choices. As central banks adjust the policy rate and signaling, households feel changes in mortgage costs, loan approvals, and monthly payments. This broader framing ties inflation and monetary policy to practical budgeting, savings, and spending decisions, helping readers plan for future cycles.

Inflation and Interest Rates: How They Reshape Purchasing Power and Household Budgets

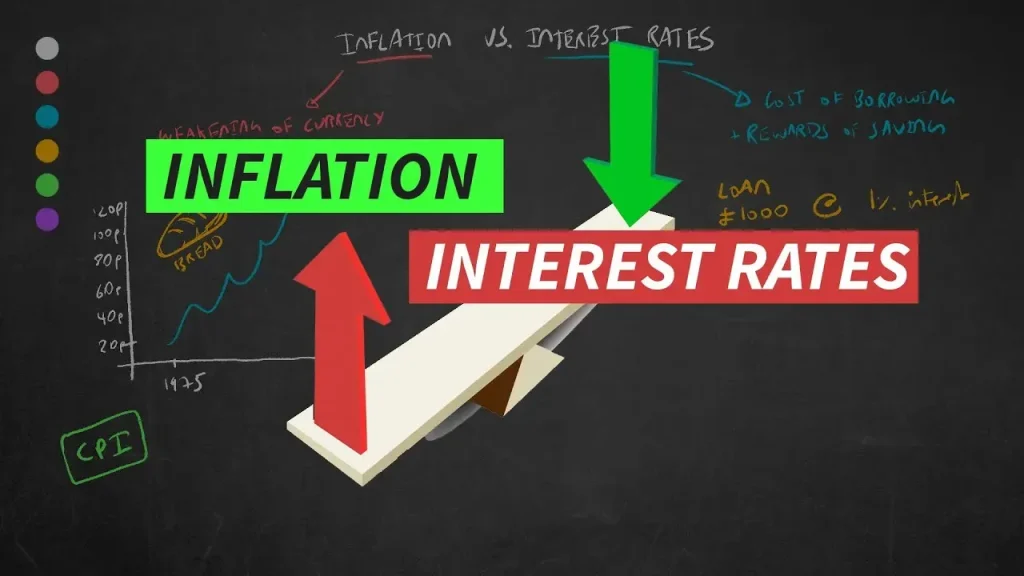

Inflation and Interest Rates are not abstract numbers; they are practical forces that determine how much your money buys and what your monthly budget looks like. When prices rise, the purchasing power of your income falls, and the inflation impact on consumers becomes visible in everyday decisions—from groceries and fuel to healthcare and housing. As prices climb, even stable wages can lag behind the cost of living, prompting families to reallocate funds, seek value, or accelerate purchases to avoid steeper costs later. In this way, purchasing power and inflation directly influence how households plan for the month ahead and for long-term goals.

When central banks tighten policy by raising interest rates, the cost of money goes up and the implications for households deepen. This is where the question of how interest rates affect households becomes concrete: higher rates raise borrowing costs for mortgages, car loans, and credit cards, which can squeeze monthly cash flow and delay big-ticket purchases. The broader effect, captured by the concept of monetary policy effects on consumer spending, is that rate changes cool demand in some sectors while reshaping how households budget for debt service, savings, and future investments.

Strategies for Consumers to Navigate Inflation and Rate Cycles

Practical, proactive steps can cushion families against rapid shifts in prices and loan costs. Start with building an emergency fund and, where possible, locking in favorable rates on major purchases to mitigate the impact of future rate hikes. Reprioritize spending by distinguishing essential needs from discretionary purchases, a strategy that aligns with the ongoing realities of cost of living and monetary policy. By focusing on essentials and maintaining flexibility, you can counterbalance the inflation impact on consumers and preserve purchasing power over time.

Longer-term resilience comes from smarter planning and diversified resources. Consider improving energy efficiency, exploring steady side income, and evaluating debt with high interest costs to reduce exposure to rate volatility. Keep an eye on rate paths and inflation expectations so you can adjust budgets and debt strategies accordingly. These actions reflect a practical application of concepts like monetary policy effects on consumer spending and purchasing power and inflation, helping families maintain financial stability while navigating the intersection of rising prices and higher borrowing costs.

Frequently Asked Questions

How do inflation and interest rates shape purchasing power and a household’s daily budget?

Inflation impact on consumers occurs when prices rise, eroding purchasing power—the same income buys less over time. This affects essentials like food, housing, and energy and can pressure savings goals. Simultaneously, higher interest rates raise the cost of borrowing, influencing mortgage payments, auto loans, and credit card minimums. The combined effect of inflation and interest-rate movements directly shapes budgeting decisions, the cost of living, and long-term planning.

What practical steps can households take to navigate inflation and rate cycles?

Focus on actions tied to monetary policy effects on consumer spending and the inflation impact on consumers: build an emergency fund, lock in fixed rates where sensible, prioritize paying down high-interest debt, revisit budgets regularly, diversify income sources, and think long term about preserving purchasing power. These strategies help households weather shifts in the cost of living and the effects of monetary policy on borrowing costs and everyday spending.

| Key Point | Description |

|---|---|

| Inflation reduces purchasing power and shapes daily choices | Inflation accelerates price increases, reducing how far money goes and influencing essential budgets like groceries, housing, and fuel. |

| Wage growth often lags price increases | Inflation impact on consumers often shows up as wage growth behind rising prices, forcing households to re-prioritize expenses, cut discretionary spending, seek value, or accelerate purchases to avoid higher costs later. |

| Interest rates raise borrowing costs and debt service | Central banks adjust policy rates; higher rates increase mortgage, student loan, auto loan, and credit card costs, affecting fixed and adjustable-rate loans and refinancing decisions. |

| Housing market and affordability | Higher rates cool housing demand, raise mortgage rates, and slow home price growth, impacting renters and first-time buyers as financing becomes more or less available. |

| Cost of living and monetary policy balancing act | Prices rise while wage growth may not keep pace, reducing real incomes; policy aims for a stable environment with affordable credit to support productive investment. |

| Monetary policy effects on consumer spending | Higher policy rates raise loan rates and tighten credit, encouraging debt paydown and saving, while lower rates can spur spending and investment; consumer confidence and expectations influence timing. |

| Strategies for consumers navigating inflation and rate cycles | Build an emergency fund (3–6 months), lock in favorable rates when possible, prioritize high-interest debt, revisit budgets regularly, diversify income sources, and invest with a long horizon and risk awareness. |

| Global dynamics and policy signals | Inflation and interest rates interact with global supply chains, commodity prices, currency fluctuations, and fiscal policies; understanding these connections helps households anticipate changes and plan accordingly. |

Summary

Inflation and Interest Rates shape how households budget, borrow, save, and plan for the future. These forces influence everyday decisions, from grocery spending to housing choices, and determine the affordability of big-ticket purchases like homes and cars. By understanding the mechanics of inflation and monetary policy, consumers can adopt proactive strategies—such as building a robust emergency fund, evaluating loan options carefully, and prioritizing essential expenses—to maintain financial stability across cycles. Staying informed about inflation trends and rate paths enables flexible, resilient planning that preserves purchasing power. Rather than fearing these forces, individuals can navigate them with preparation and disciplined financial habits that support long-term well-being.