Understanding the Economy is a concept that often feels opaque to newcomers, yet this beginner-friendly guide breaks it down into practical terms you can relate to daily life. If you’re exploring economy for beginners, this primer breaks down macroeconomics basics into plain language and real-world examples, so you can see how big ideas connect to groceries, jobs, and paychecks in your own budget, and shape your future income prospects. We’ll translate economic indicators explained into clear signals you can track—like GDP, unemployment, and the path of inflation explained—so you can interpret headlines without getting overwhelmed and make sense of what the numbers mean for your daily decisions, including how to save, borrow, or invest. By focusing on the core mechanics of how markets work, we reveal how prices, supply, and demand steer production, investment, and consumer choices in everyday life, from groceries to gadgets and big-ticket purchases, and we connect these ideas to policy moves that affect jobs and wages. Across practical examples, simple exercises, and friendly explanations, this guide helps you move from confusion to confidence, giving you a framework to read news, compare options, and discuss economic topics with clarity, at home, at work, or with friends.

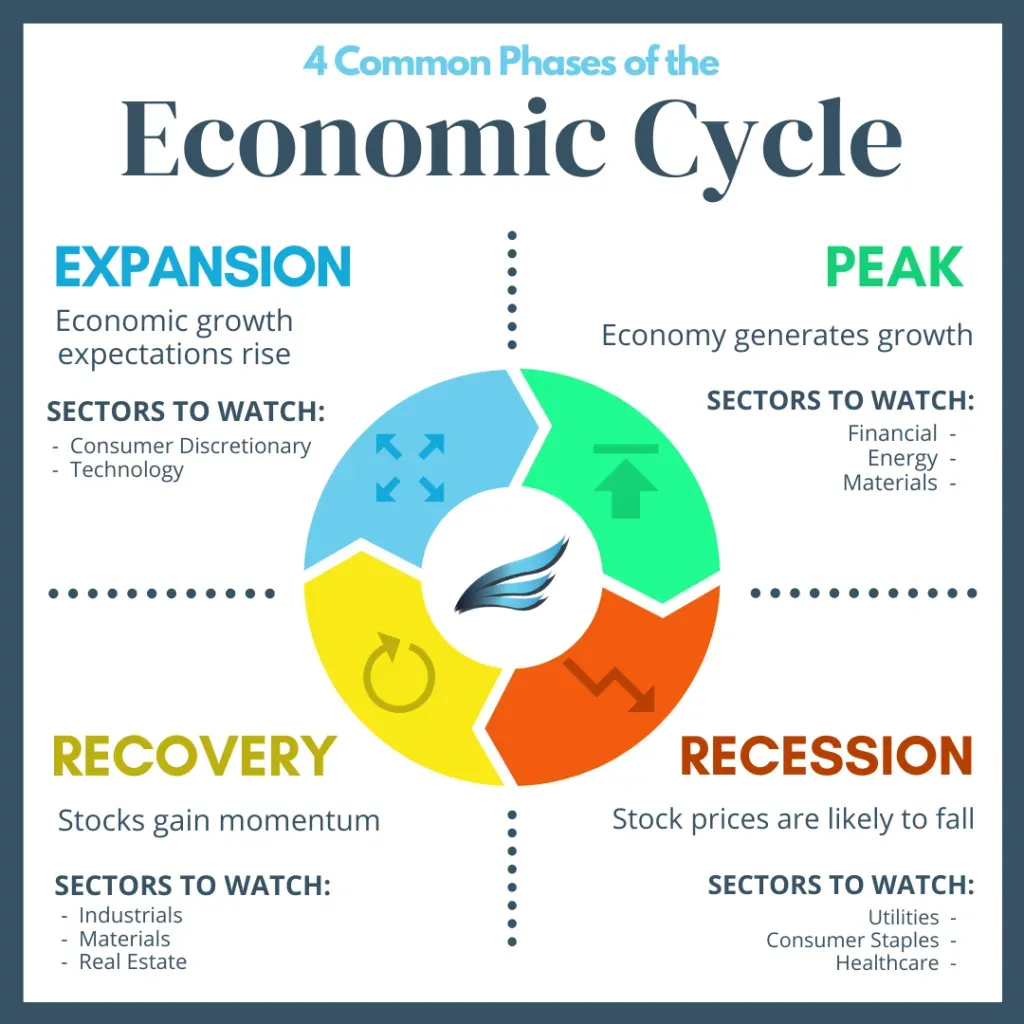

In different words, think of the economy as a living system—the broad financial habitat where households, firms, governments, banks, and markets continually interact. Viewed this way, the same ideas appear under alternative labels—macroeconomic climate, national growth trajectory, or the health of the economy—helping you recognize patterns across reports and forecasts. Latent Semantic Indexing principles guide us to include related terms such as consumer price trends, business cycles, monetary policy, fiscal policy, and market dynamics, so you learn to connect new information to familiar concepts. By using these connected terms, you build a web of meaning that makes headlines, charts, and data feel approachable rather than intimidating.

Understanding the Economy: A Beginner’s Guide to Macroeconomics Basics

Understanding the Economy can feel daunting, but from the perspective of economy for beginners it boils down to three simple ideas: production, income, and spending. The circular flow models helps you visualize how households supply labor and capital to firms, earn wages and profits, and then use that income to buy goods and services. Framed this way, macroeconomics basics become a practical lens on everyday life rather than abstract theory.

Keeping an eye on economic indicators explained helps you translate headlines into concrete meaning. Key metrics like GDP, unemployment, and inflation rates tell you whether the overall economy is expanding, how jobs are faring, and how price levels are moving. When you learn inflation explained in plain terms, you start to see how wage growth, consumer prices, and policy decisions interact in real life.

Putting these ideas together, you’ll see how markets work in daily life and how macroeconomics basics shape the news you read. Describing the economy in practical terms means learning to read headlines with a beginner-friendly toolkit: watch trends over several months, compare growth with employment shifts, and note central bank signals about interest rates. The price signals and resource allocations you observe in markets help explain your everyday purchases, savings, and investment choices.

Markets in Focus: How Markets Work and Economic Indicators Explained for Everyday Decisions

Even if you’re new to the topic, understanding how markets work gives you a clear view of price signals and resource allocation. Supply and demand dynamics determine what gets produced, at what cost, and how buyers and sellers converge on a fair price. This is the practical core of macroeconomics basics, linking the daily price of groceries to broader shifts in the economy for beginners.

Economic indicators explained becomes particularly useful when you’re budgeting or planning big decisions. Track GDP growth, the unemployment rate, and inflation rate to gauge the momentum of the economy, while consumer confidence and interest rates give clues about future spending and borrowing costs. When inflation explained appears in the news, you’ll understand how higher prices affect your mortgage, car payments, and everyday purchases.

By tying these indicators to your personal finances, you turn abstract data into actionable steps: adjust savings plans if inflation is rising, diversify investments when growth accelerates, and prepare for shifts in loan rates as central banks respond to the economy. This approach keeps you prepared and confident as the market of prices, wages, and opportunities evolves, reinforcing the idea that learning economy topics like how markets work and economic indicators explained pays off in daily life.

Frequently Asked Questions

Understanding the Economy for beginners: what are macroeconomics basics and why do they matter?

Understanding the Economy for beginners means seeing it as the system that produces, distributes, and consumes goods and services. Macroeconomics basics cover big‑picture factors like GDP, unemployment, inflation, and interest rates that shape jobs and prices. If you’re studying economy for beginners, these concepts help you read headlines, track growth, and make smarter budgeting decisions.

How do economic indicators explained help you interpret the economy, and what role does inflation explained play in daily decisions?

Economic indicators explained are statistics that show the economy’s health, including GDP, unemployment, inflation, consumer confidence, and interest rates. Inflation explained describes why prices rise, how purchasing power changes, and how central bank policy affects loan costs and everyday expenses. By understanding these ideas, you can better budget, save, and plan major purchases, and read economic news with more confidence.

| Key Point | Description |

|---|---|

| Understanding the Economy | A concept that often feels opaque, but can be demystified. This guide aims to provide a practical framework to interpret news, assess market changes, and feel more confident discussing economic topics with real-life examples. |

| Main concepts: production, income, and spending | The economy is a network where goods and services are produced, distributed, and consumed, involving households, businesses, governments, banks, and international trade. Production creates income (wages/profits), which is spent on goods and services, circulating back through the economy. |

| Circular flow model | Households provide labor and capital; firms produce goods and services; households earn wages/profits and spend. Government taxes and spends, banks/markets handle borrowing and saving, shaping growth. |

| Macro economics basics | Focuses on GDP, unemployment, inflation, and interest rates to gauge overall health. Growth comes from spending and investment, balanced with price stability and sustainable employment. |

| Economic indicators explained | Key metrics include GDP, unemployment rate, inflation rate, consumer confidence, and interest rates. They help translate theory into everyday decisions, though they’re not perfect. |

| Inflation explained | Inflation measures rising prices over time. Causes include demand-pull, cost-push, and monetary policy. Central banks adjust rates to manage inflation, which affects loans, mortgages, and big purchases. |

| How markets work | Markets operate on supply and demand. Price signals guide production and investment. When demand exceeds supply, prices rise; when supply exceeds demand, prices fall, leading to resource allocation and efficiency gains. |

| Reading economic news | Practical tips: focus on trends, compare GDP growth with unemployment, watch central bank signals, and interpret indicators in context rather than chasing a single data point. |

| Personal decisions today | Apply concepts to budgeting, saving, and upskilling. Inflation trends and policy changes affect loans and payments, so thinking in terms of production, income, and spending guides daily choices. |

Summary

Conclusion