The recent US China tariff agreement marks a significant milestone in the ongoing saga of US China trade talks, highlighting a breakthrough in trade tensions that have long affected global markets. This pivotal deal entails a temporary suspension of most tariffs, allowing for a dramatic reduction from an imposing 125% to just 10% on reciprocal tariffs between the two economic giants. By fostering a more cooperative stance, this agreement aligns with broader goals of tariff reduction, promoting stability in economic relations. U.S. Treasury Secretary Scott Bessent emphasized the positive momentum achieved during discussions, suggesting a renewed focus on collaborative China US economic policy. As investors celebrated this thaw in relations, the agreement showcases a crucial step towards mitigating long-standing trade disputes and sets the stage for ongoing negotiation of trade policies between both nations.

In a groundbreaking development, the recent consensus between the United States and China concerning tariff modifications signals a major step forward in their bilateral relations. This accord, which suspends numerous tariffs, is indicative of the easing of long-standing trade confrontations that have impacted both economies. By addressing reciprocal tariff levels and committing to further economic dialogue, both countries are setting a framework for a more productive trading environment. The latest shift reflects a broader strategy to enhance cooperation in a complex global trade landscape. As discussions continue, this agreement not only paves the way for decreased tariffs but also fosters an atmosphere of economic collaboration that can benefit numerous sectors in both nations.

Understanding the US China Tariff Agreement: Key Details and Implications

The recent US China tariff agreement marks a significant turning point in the long-standing trade tensions that have characterized relations between the two economic giants. By agreeing to slash tariffs for a period of 90 days, both nations have opened the door for a more collaborative economic relationship. Previously, reciprocal tariffs had reached as high as 125%, creating barriers that hindered trade and disrupted supply chains. Now, with these tariffs reduced to just 10%, we see promising developments for businesses and consumers alike, as this move is expected to lower costs and stabilize markets.

This temporary agreement on tariffs is a testament to the importance of the US China trade talks that took place recently in Switzerland. U.S. Treasury Secretary Scott Bessent emphasized the productive nature of these discussions, stating that the Lake Geneva setting contributed to the positive outcomes. The agreement not only solidifies the commitment of both nations to engage in ongoing dialogue regarding economic and trade policy but also reflects a shared desire to de-escalate the frictions that have previously affected bilateral relationships.

The Economic Impact of Tariff Reduction on US and China

The economic implications of the recent tariff reduction between the U.S. and China cannot be understated. With attorneys, investors, and policymakers closely monitoring the developments, this agreement serves to enhance economic stability as both countries navigate their trade policies. Analysts predict that reducing tariffs from 125% to 10% will rejuvenate trade volumes, benefitting sectors heavily reliant on imports and exports. For instance, reduced costs for American importers could encourage businesses to expand, thus potentially leading to job creation and a boost in the overall economy.

Moreover, as trade tensions begin to ease, we might expect a ripple effect on global markets. The initial positive investor reactions suggest optimism about growth prospects. Nasdaq futures indicated a striking 3.6% gain upon the announcement of the tariff suspension. Such movements within financial markets are indicative of restored confidence in China US economic policy and its ability to foster a more integrated global economic environment.

Future Prospects for US China Trade Relations Post Agreement

Looking ahead, the future of US China trade relations will largely depend on the effectiveness of this 90-day tariff agreement. It acts as a critical first step towards more comprehensive negotiation efforts, addressing broader economic policy issues that have historically faced detachment from trade discussions. Both countries have assured that dialogues will continue, providing ample opportunities for further agreements that can address remaining tensions.

For businesses, the stabilization of trade policies is crucial; they thrive on predictability and may potentially recalibrate their strategies based on the outcomes of future negotiations. The return to cooperative discussions could lead to more significant tariff reforms, and possibly pave the way for long-term agreements that would reduce trade barriers permanently, advancing mutual economic objectives.

The Role of Reciprocal Tariffs in Trade Negotiations

Reciprocal tariffs play a critical role in shaping trade negotiations between countries, particularly in the context of the US China tariff agreement. The decision to reduce reciprocal tariffs from 125% to 10% signals a willingness from both sides to create a more equitable trading environment. By lowering these tariffs, the nations are not only addressing immediate economic concerns but are also laying the groundwork for future cooperation.

Furthermore, these discussions around reciprocal tariffs highlight the importance of fairness in international trade agreements. As countries work towards mutually beneficial arrangements, understanding how reciprocal tariffs might adjust provides insights into negotiation tactics that can help de-escalate trade conflicts. Striking a balance that satisfies both parties is essential for long-term stability.

Trade Tensions: Past Challenges and Current Resolutions

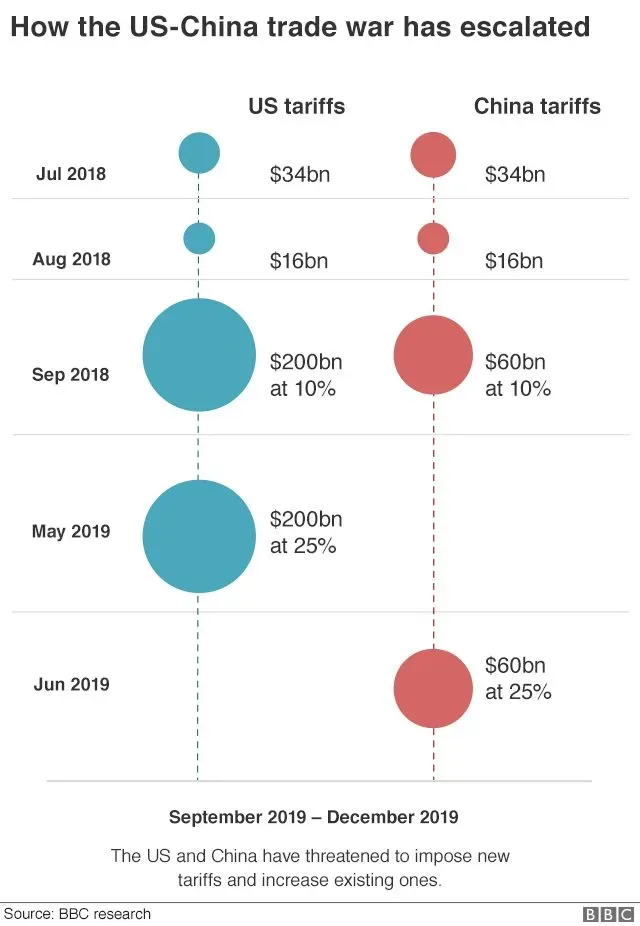

The roots of trade tensions between the U.S. and China run deep, stemming from a myriad of economic policies and practices perceived as unfair. Tariff impositions served as the frontline strategy for both nations, impacting everything from consumer prices to international relations. However, this new agreement represents a substantial shift towards conflict resolution, emphasizing negotiation over unilateral trade actions.

Current resolutions aim not only to mitigate the economic impacts of high tariffs but also to restore confidence among businesses and investors alike. As trade relations thaw, the focus will likely shift towards more sustainable economic strategies that prioritize cooperation, further reducing the risk of future tensions.

Investor Reactions to the Tariff Agreement: Positive Indicators

The announcement of the tariff agreement between the U.S. and China elicited a positive response from investors, illustrating the interconnectedness of trade policies and market reactions. With Nasdaq futures projecting a 3.6% gain and the Dow Jones surging by nearly 1,000 points, it is clear that confidence in the stability and predictability of the markets is returning. Such immediate financial responses underscore the market’s sensitivity to shifts in trade relations and economic policy.

Positive investor sentiment suggests that the reduction in tariffs may lead to improved performance for sectors heavily involved in trade with China. As businesses anticipate reduced costs, financing, and consumer prices may enhance market competitiveness, further driving investment decisions. In this context, clear communication and sustained dialogue between economic powers are fundamental for maintaining bullish market trends.

The Strategic Importance of Continued US China Trade Talks

The strategic importance of ongoing US China trade talks cannot be overstated. As both nations continue to engage positively in negotiations, the potential for further agreements grows. Sustained discussions are crucial not only for resolving outstanding issues related to tariffs but also for addressing broader economic policies that impact global trade dynamics.

Additionally, continued engagement can foster mutual understanding, reducing the risk of misunderstandings that often lead to economic escalations. Regular dialogue allows for adjustments in policies and provides a platform for both sides to express concerns and seek collaborative solutions. This strategic alignment is essential for the stability of not just US and China relations but also the wider global economy.

Potential Lasting Effects of the Tariff Suspension on Global Trade

The suspension of tariffs between the U.S. and China could herald lasting effects on global trade. In an increasingly interconnected economy, the moves made by these two superpowers can ripple across various markets and affect trading relationships worldwide. As tariffs lower and trade barriers diminish, we could witness revitalized trade flows, benefiting many economies that rely on exports to either the U.S. or China.

Moreover, a successful resolution in US China trade talks might encourage cooperation among other countries, sparking a broader trend of tariff reductions and trade liberalization globally. Such movements could eventually cultivate a more stable and predictable trading environment, positively impacting international commerce.

Navigating Future Trade Policies in a Transformed Economic Landscape

As we embark into a new era characterized by the US China tariff agreement, navigating future trade policies requires thoughtful consideration of the interests of all stakeholders involved. This transformed economic landscape may compel nations to reconsider their tariff strategies and trade agreements to ensure that they align with evolving market needs.

To successfully adapt to these changes, businesses and policymakers will need to remain agile and responsive. Ongoing evaluation of market dynamics and consumer behavior will be essential in maintaining competitiveness, and collaboration will play a vital role in fostering an environment conducive to growth and innovation, representative of a globally integrated economy.

Frequently Asked Questions

What does the recent US China tariff agreement entail?

The recent US China tariff agreement entails a temporary suspension of most tariffs on goods exchanged between the two nations. This marks a significant reduction in trade tensions, lowering reciprocal tariffs from 125% to 10%, while maintaining a 20% duty on specific Chinese imports related to fentanyl, leaving total tariffs at 30%.

How will the US China trade talks affect global markets?

The US China trade talks have positively impacted global markets, with significant increases in major US stock indices like the Nasdaq and S&P 500 following the announcement of the tariff reductions. The agreement reflects a shift towards a more favorable economic environment, encouraging investor confidence.

Will the US China tariff agreement lead to further trade negotiations?

Yes, the US China tariff agreement is not final. Both countries have committed to continue discussions on broader economic and trade policy, indicating that more negotiations could take place to resolve remaining issues and enhance trade relations.

What implications does the US China tariff agreement have for businesses?

The US China tariff agreement has positive implications for businesses engaged in cross-border trade. By lowering tariffs, companies can reduce costs on goods and enhance competitiveness. This shift is particularly beneficial for industries reliant on imported materials from China.

What are reciprocal tariffs in the context of the US China trade talks?

Reciprocal tariffs are tariffs imposed by each country against the other in response to trade barriers. In the context of the US China trade talks, these tariffs have been reduced significantly, aiming to promote a more balanced trade relationship and alleviate economic tensions between the two nations.

What specific goods are affected by the current US China tariff agreement?

Under the current US China tariff agreement, most goods exchanged between the two nations will benefit from lowered tariffs, while specific imports from China related to fentanyl will still incur higher duties, maintaining a total tax of 30% on those items.

How does the US China economic policy influence global trade dynamics?

The US China economic policy, especially in light of the recent tariff agreement, plays a critical role in shaping global trade dynamics. As the world’s largest economies work towards reducing trade barriers, it can lead to increased economic cooperation, affecting trade flows and economic stability worldwide.

What was the role of the Geneva talks in the US China tariff agreement?

The Geneva talks were pivotal in reaching the US China tariff agreement. Held in an environment conducive to dialogue, these negotiations resulted in substantial tariff reductions, demonstrating the importance of diplomatic discussions in resolving trade tensions.

How might the US China tariff agreement impact US consumers?

The US China tariff agreement may lower prices for various goods imported from China, benefiting US consumers. Reduced tariffs can lead to decreased costs for retailers, potentially resulting in lower prices for end consumers on a wide range of products.

What is the expected duration of the US China tariff agreement?

The US China tariff agreement is set for a provisional period of 90 days, during which both nations will assess the impact of the tariff suspensions and continue to engage in talks to address outstanding trade issues.

| Key Points | Details |

|---|---|

| Agreement on Tariffs | U.S. and China agreed to suspend most tariffs on each other’s goods. |

| Timeframe | The suspension of tariffs will last for 90 days. |

| Reduction in Tariffs | Reciprocal tariffs lowered from 125% to 10%; U.S. duties on fentanyl imports remain at 20%. |

| Key Officials | U.S. Treasury Secretary Scott Bessent praised the talks held in Lake Geneva. |

| Market Reaction | Positive investor response with notable gains in U.S. stock indexes and a rise in the U.S. Dollar Index. |

Summary

The US China tariff agreement marks a significant moment in the ongoing economic relationship between the two countries. By agreeing to suspend most tariffs for 90 days, both nations are taking a step toward easing trade tensions, potentially paving the way for a more stable economic environment. This deal highlights a willingness on both sides to engage in dialogue and seek mutually beneficial outcomes, a hopeful sign for future negotiations.