Hong Kong stocks are at the forefront of the market rebound in Asia, driven by optimism surrounding potential de-escalation in U.S.-China trade tensions. This revitalization comes in the wake of encouraging comments from U.S. President Donald Trump, suggesting tariffs might not reach the heights initially feared, which has bolstered investor sentiment across the region. The Hang Seng Index demonstrated notable movement, surging 2.48% early in the trading session, reflecting broader gains in the Asia-Pacific markets. Chinese equities listed in Hong Kong also recorded substantial increases, further propelling the local market dynamics. As investors eagerly anticipate further developments, the backdrop of easing trade tensions remains key to sustaining momentum in the Asian stock market gains.

The surge in Hong Kong equities marks a significant uptick in financial activity within this vibrant marketplace. Known for its dynamic trading environment, the region’s stock market is witnessing a rally fueled by positive news regarding international trade relations, particularly between the U.S. and China. As the Hang Seng Index climbs, the sentiment among investors favors a more stable economic outlook, inviting increased participation in the market. Moreover, with optimism regarding the easing of heightened tariffs, this bustling financial center is experiencing robust activity, reminiscent of its vital role in the Asian economic landscape. Overall, the latest shifts highlight Hong Kong’s significance as a pivotal player in the global investment arena.

Optimism in Hong Kong Stocks Amid U.S.-China Trade Discussions

Hong Kong stocks are at the forefront of the recent bullish trend in Asian markets, greatly influenced by the evolving narrative in U.S.-China trade relations. The Hang Seng Index’s impressive rise of 2.48% is a clear indication of investor optimism, as traders respond positively to statements suggesting that tariff escalations may not reach initially projected levels. This wave of enthusiasm has extended beyond the Hang Seng Index to include other indices such as the Hang Seng Tech Index, which jumped by 3.21%, showcasing substantial gains across varied sectors. As confidence grows, market participants are keenly looking for indicators that further de-escalation in trade tensions is on the horizon, boosting sentiment in the process.

The robust performance of Hong Kong stocks, particularly driven by technology shares and consumer cyclicals, indicates that investors are actively seeking opportunities amid potential stability. Major players like Xiaomi and Alibaba have seen their stocks increase significantly, reflecting a renewed faith in the market as easing tensions may lead to more favorable conditions for trade. This optimism stretches beyond the local economy, as fluctuations in investor sentiment may ripple through other regions, encouraging broader participation in the Asia Pacific markets. Overall, as Hong Kong leads gains in Asia, its ability to navigate the complexities of international trade dynamics will be essential for sustained growth.

Broader Impact of U.S.-China Trade Relations on Asia Pacific Markets

The recent developments in the U.S.-China trade narrative have had a resounding impact across Asia Pacific markets, leading to increased investor enthusiasm. The surge in acquisitions and stock prices observed in Japan’s Nikkei 225 and Australia’s S&P/ASX 200 signals a growing regional confidence anchored in the possibility of trade stability. With significant upward movements across major stock indices, including a broad-based advance in South Korea’s Kospi, it is evident that the Asia Pacific markets are closely intertwined with the outcomes of U.S.-China discussions. Stable trade relations are viewed as crucial for sustaining economic momentum throughout the region.

Furthermore, the encouraging signs from Wall Street add an essential layer of support for the Asia Pacific markets, where investors embrace the positive sentiment emanating from the West. As the Dow rebounds, marking a significant 2.66% rise overnight, investors across Asia are likely to ride on this momentum. Increased market confidence could lead to more capital inflows into Asian equities, thus enhancing investor sentiment even further and potentially rewiring short-term trading strategies. Given this interconnectedness, stakeholders across industries in the Asia Pacific region must remain agile and informed about ongoing developments in U.S.-China trade policies to navigate potential market shifts.

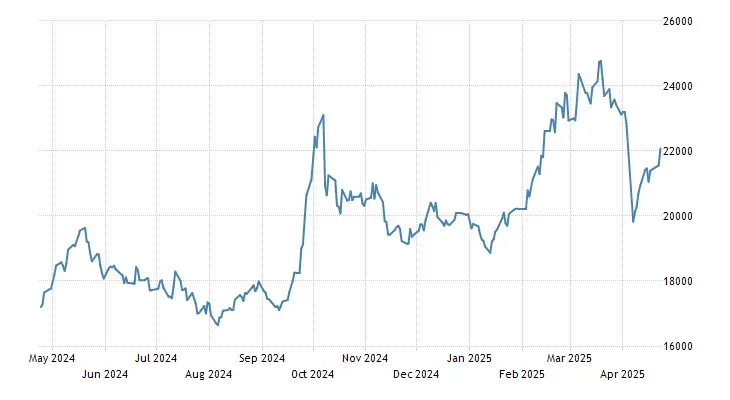

The Hang Seng Index: A Beacon for Asian Stock Market Gains

The Hang Seng Index serves as a critical barometer for Asian stock market performance, particularly during volatile trading conditions influenced by geopolitical factors. With its recent uptick reflecting a 2.48% increase, it is clear that Hong Kong stocks are leading the charge in market recovery. The index, which includes a diverse range of sectors, benefits from robust performances from key players in the tech and consumer goods markets, contributing significantly to positive movements in the broader Asian context. Investors are keenly observing these developments, as gains in the Hang Seng Index often set the tone for market activities across Asia.

Moreover, as the Hang Seng Index aligns itself with broader themes of optimism regarding U.S.-China trade negotiations, it further solidifies its importance within the Asian markets. The synchronization of gains with indices in Japan and Australia illustrates a pattern of reinforcement among regional markets that may foster greater collaboration and investment opportunities. With heightened investor sentiment in the wake of easing tensions, the Hang Seng Index acts as a leading indicator of potential gains, encouraging market watchers to explore emerging trends and shifts across the Asian financial landscape.

Understanding Investor Sentiment Amid Market Optimism

Investors’ confidence plays a crucial role in determining stock market trajectories, especially in contexts like the current optimism surrounding Hong Kong stocks and U.S.-China trade relations. With the emphasis on potential easing of tariffs, investor sentiment has improved, prompting an influx of capital into equities. This shift is not only visible in Hong Kong but also resonates across several other Asian markets, highlighting the profound impact that sentiment can have on market movements. As such, investors are encouraged to remain attuned to external influences, including geopolitical developments, to make informed trading decisions.

Additionally, market participants are leveraging this positive sentiment to reassess their portfolios, recognizing sectors that may benefit most from an easing of trade tensions. Financial and technology stocks stand out as potential frontrunners, reflecting a collective belief that positively influencing factors can create an environment conducive to sustained growth. This heightened focus on investor sentiment underlines the need for vigilance among traders, as market mood can pivot sharply based on new information or developments, particularly within the overarching framework of U.S.-China relations.

The Role of Technology Stocks in Market Recovery

As evidenced by recent performances, technology stocks have emerged as pivotal components in the rally of Hong Kong stocks and broader Asian markets. Companies like Xiaomi and Alibaba have captured investor attention with impressive gains, driven by expectations of a more favorable business environment amid easing trade tensions. The technology sector not only plays a significant role in the Hang Seng Tech Index but also in the Hang Seng Index as a whole, driving broader market trends and establishing momentum for growth. With technology being a significant engine of economic progress, its recovery has profound implications for market trajectories across the Asia Pacific region.

Furthermore, the resilience of technology stocks amid fluctuating trade philosophies emphasizes the sector’s critical role even when faced with uncertainty. Investors are increasingly aware that robust financials and innovative growth strategies can shield tech firms from market volatility. This duality serves as a foundation for recovery in Asian markets, as tech stocks help anchor investor confidence and attract further investments. As discussions continue around U.S.-China relations, tech stocks are likely to maintain their status as leaders in market recovery, influencing investor tactics regionally and globally.

Impacts of Tariff Discussions on Market Dynamics

The ongoing discussions around tariffs between the U.S. and China directly affect market dynamics across the globe, leading to shifts in investor strategies and overall market health. The latest comments from U.S. President Donald Trump regarding tariff rates have sparked renewed optimism among investors, alleviating some anxiety and resulting in significant gains within several Asian indices. This desire for clarity in trade policies is paramount for maintaining momentum in the Hong Kong stock market, which has been experiencing a notable rally, particularly within key sectors that directly benefit from these discussions.

Moreover, markets within the Asia Pacific region are closely monitored as they respond to news regarding tariff negotiations, with investors keen on capitalizing on favorable outcomes. As the Hang Seng Index and other regional indices exhibit upward trends following optimistic signals, the overarching theme remains clear—successful negotiations can lead to a cascading effect, propelling stock market growth across multiple sectors. The interconnectedness between market sentiment and trade discussions highlights the need for vigilant observation of evolving dynamics, ensuring that investors can adapt swiftly in response to changes.

Following the Hang Seng China Enterprises Index Trends

The Hang Seng China Enterprises Index has become a crucial reference point for understanding the performance of Hong Kong-listed Chinese stocks, particularly in the context of shifting investor sentiment and market trends. In light of recent market movements, the index demonstrated strong gains, driven by optimistic indicators surrounding U.S.-China trade relations. Stocks within this index, especially in the technology and consumer sectors, have outperformed, providing invaluable insights into how interconnected these markets have become. The rise in this index signifies not only confidence among investors but also the potential for sustained growth in the future as trade tensions ease.

Moreover, the consistent performance of the Hang Seng China Enterprises Index reflects the broader maneuvering within the Asian stock market. Its ability to absorb gains from leading players indicates that a diverse portfolio could serve investors well during times of volatility. The index acts as a bellwether for the overall health of Hong Kong’s market landscape, particularly as economic relations with China influence market sentiments. As such, monitoring its trends closely will provide investors with a clearer picture of market dynamics and potential investment opportunities as conditions evolve in the Asia Pacific region.

Gold Market Fluctuations in Response to Investor Sentiment

The fluctuations in the gold market serve as an interesting barometer of investor sentiment amidst prevailing discussions about U.S.-China trade tensions. Recently, as optimism in Asia-Pacific markets surged, gold prices took a downturn from record highs, indicating a shift in investor confidence towards equities and riskier assets. This can often reflect a dichotomy where fears of economic instability prompt a flight to safety, while improving sentiment allows investors to pivot back towards risk assets like stocks. Consequently, this phenomenon highlights how gold, traditionally viewed as a safe haven, is influenced by broader market sentiments.

In the current landscape, as optimism about easing trade tensions takes hold, market players are likely to recalibrate their assets, favoring stocks over gold in anticipation of more fruitful returns from equities. The ongoing dialogue surrounding tariff adjustments and their implications for investor sentiment will remain critical in shaping these market behaviors. Defining this relationship between gold prices and stock market trends allows investors to make strategic decisions based on the interplay of risk aversion and risk appetite in response to shifting geopolitical landscapes.

Frequently Asked Questions

How are Hong Kong stocks impacted by U.S.-China trade tensions?

Hong Kong stocks are significantly influenced by U.S.-China trade tensions since they attract substantial investment from mainland China and global investors. Positive developments, such as the recent indication from U.S. President Trump that tariffs may not be as high as feared, tend to boost investor sentiment, leading to gains in key indices like the Hang Seng Index.

What is the Hang Seng Index and its importance to Hong Kong stocks?

The Hang Seng Index is a market capitalization-weighted index of the largest companies listed on the Hong Kong Stock Exchange, representing a major indicator of Hong Kong stocks’ performance. A rising Hang Seng Index, influenced by factors like U.S.-China trade relations, reflects optimism among investors and can attract more capital into the market.

What trends are seen in Hong Kong stocks amid the broader Asia Pacific markets?

Recently, Hong Kong stocks have shown a leading trend in the Asia Pacific markets, often responding positively to regional and global developments. For instance, an optimistic outlook regarding U.S.-China trade tensions has led to significant gains in the Hang Seng Index, positioning Hong Kong as a key player in Asian stock market gains.

How do Hong Kong-listed Chinese stocks perform in relation to investor sentiment?

Hong Kong-listed Chinese stocks closely reflect investor sentiment, particularly in response to geopolitical developments such as U.S.-China trade tensions. When tensions ease, investor confidence typically rises, resulting in notable gains for major stocks like Alibaba and Xiaomi, which have recently benefitted from improved sentiment.

What factors drive investor sentiment towards Hong Kong stocks during market fluctuations?

Investor sentiment towards Hong Kong stocks is primarily driven by geopolitical events, such as U.S.-China trade tensions, as well as local economic indicators. Factors like government policies, market performance, and global economic conditions play a crucial role in influencing investor decisions and the overall performance of the Hong Kong stock market.

| Market | Index Performance | Key Drivers | Notable Stocks |

|---|---|---|---|

| Hong Kong | Hang Seng Index +2.48% | Optimism over U.S.-China trade tensions eases | Xiaomi +6.53%, Alibaba +5.82% |

| Mainland China | CSI 300 +0.22% | Easing tensions and stable economic outlook | N/A |

| Japan | Nikkei 225 +2.09% | Positive sentiment from geopolitical developments | N/A |

| India | Nifty 50 +0.64% | General market recovery in Asia | N/A |

| South Korea | Kospi +1.51% | Positive regional market performance | N/A |

| Australia | S&P/ASX 200 +1.22% | Recovery from recent declines | N/A |

Summary

Hong Kong stocks surged amidst rising optimism regarding U.S.-China trade relations as investors anticipated a potential decrease in tariffs. The Hang Seng Index, along with significant gains in technology and consumer cyclicals, rallied sharply by 2.48%. This positive trend not only reflects the resilience of the Hong Kong market but also highlights investor confidence in a more stable geopolitical climate, making Hong Kong stocks a focal point for those looking to capitalize on market rebounds.